Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

It was interesting, as the way people choose to manage their finances usually is

Money and comparison. We are all guilty of measuring our lives with others. As interesting as it is to see how your financial life compares to others, the truth of the matter is that it probably doesn’t. We all (well, most of us) have to go to work, save money the conventional ways, and maybe most unrealistically of all — live a life that seems “normal.” We all choose to do different jobs, save for different things, and decide our own “normal.” So, when you think about others and try to compare yourself to them, can you even? Your best friend with a four-bedroom home in an upper-class neighbourhood. Your cousin with two sports cars and a motorcycle. Your co-worker who wears new designers boots every week.

You literally can’t even.

For starters, a four-bedroom house for you and your dog is ridiculous. Two sports cars and a motorcycle? I mean, you hate driving. And sure, designer boots are cute, but, you already have a pair that you love so why buy another? A comparison is kind of crazy considering the fact that we are all different.

We all crave financial success at different points in life

Just five short years ago, I was completely financially illiterate. An influx of cash was thrilling in a different kind of way than it is today. I once perceived money as a temptation. Any money that I earned was spent almost immediately and on anything I could imagine. If I didn’t have something I wanted, I’d find a way to blow the cash that sat in my bank account anyways. In other words, money was meaningless to me. Its purpose was nothing but a form of bait.

Credit cards, or phantom money as I like to call them, were all the same. Within a few years, my debt became my existence. I would joke about how miserable I was and how I didn’t have a penny to my name in hopes that I would appear okay to everyone else who was more financially equipped than me. Low points were just something I’d worry about later, and high points were anytime I paid off a portion of my credit card so that I could go max out my limit — yet again.

Times change and so does your perspective

About a week ago, my husband won $300 from his fantasy football league. Yeah, he’s like, super cool you guys. He joked about how different life is now. His exact words were, “You know you’re growing up when you go to deposit your winnings into the bank, and it doesn’t even touch your checkings.” The money went straight into savings and straight towards one of our financial goals. It’s what we do with most of our disposable income. It’s not that we don’t like to enjoy the money on fun events or things we want — it’s just that now we take more enjoyment watching our accounts go up than spending disposable income on frivolous nights out. After all, five years ago if I got $300, it was likely gone before I could even get to the bank to deposit the funds.

Curious as always, I wanted to survey 100 other people to see what they would do if they had received an influx of cash. I wished to know if they would consider investing or saving. I made sure the survey was anonymous so that those who felt as though they’d spend it didn’t feel judged. It was interesting, as the way people choose to manage their finances usually is.

Who took the survey?

88 females

17 males

Age 20 to 25

28

Age 26 to 29

54

Age 30+

23

A disposable income breakdown

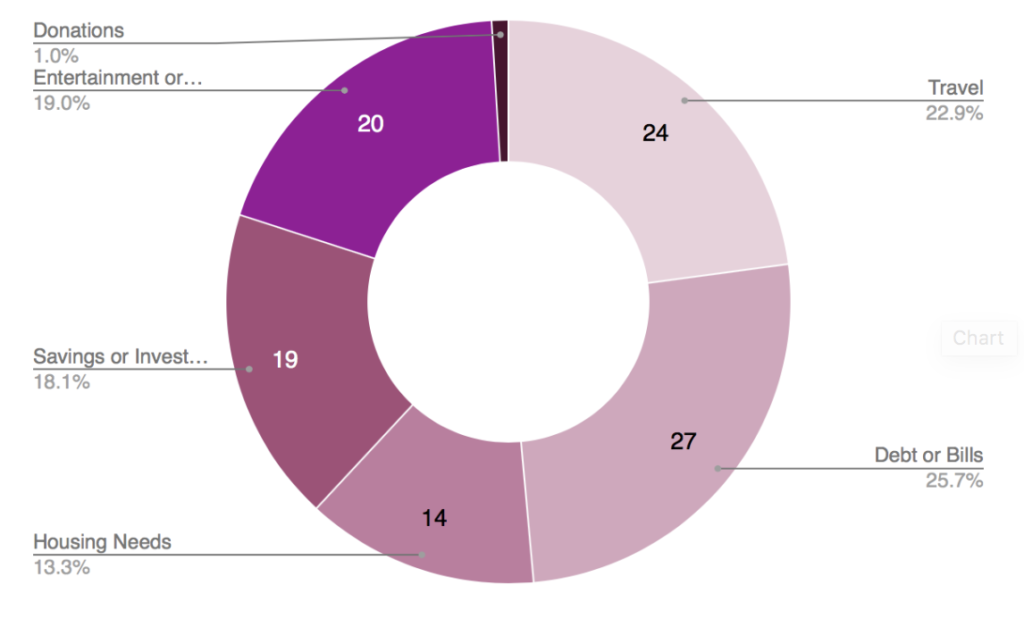

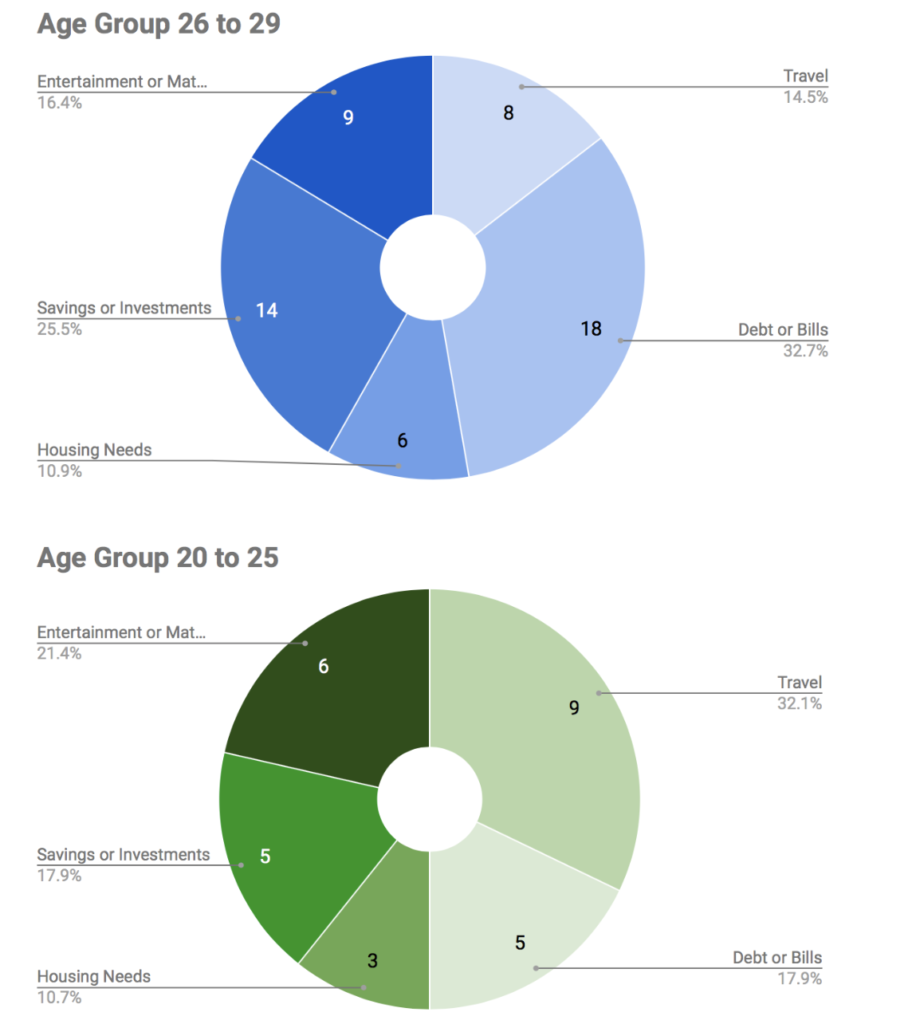

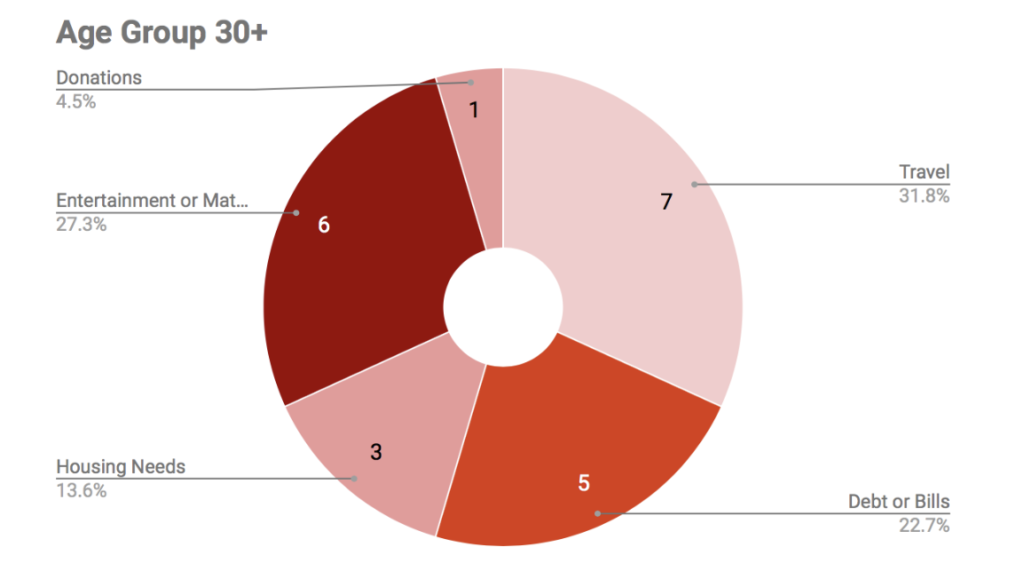

A survey taken by 88 women and 17 men revealed a lot about how unique, but similarly, we plan to spend our money. I received a ton of specific answers but categorized them based on their closest category whether that were savings or investments, entertainment or material items, travel, housing needs, debt or bills, and donations.

Breakdown by age group

Stop worrying about what others are doing with their money and focus on your own financial goals

At the end of the survey, I simply asked individuals whether they usually spend their disposable income or choose to save it. I was super happy to see that 70% typically save and unsurprised to see that 30% tend to spend. However, a small survey sample of 100 people shouldn’t determine whether you’re on the right track with your money. A small survey sample of 100 people should help you realize that not everyone is doing the exact same things or worrying about the exact same priorities. We are all continually evolving our money mantras as we grow, and some people take longer to grow than others. My only advice to friends who ask me how they can better their financial situations is to actually take time to discover where their money goes.

Once you know where you spend your money each month, you’ll start to understand why your financial situation is the way it is. Adjustments can only be made once you are ready. However, if you’re concerned about your finances, one can only assume that you already are.

What would you spend $500 of disposable income on today? Let me know in the comments!

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.