Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

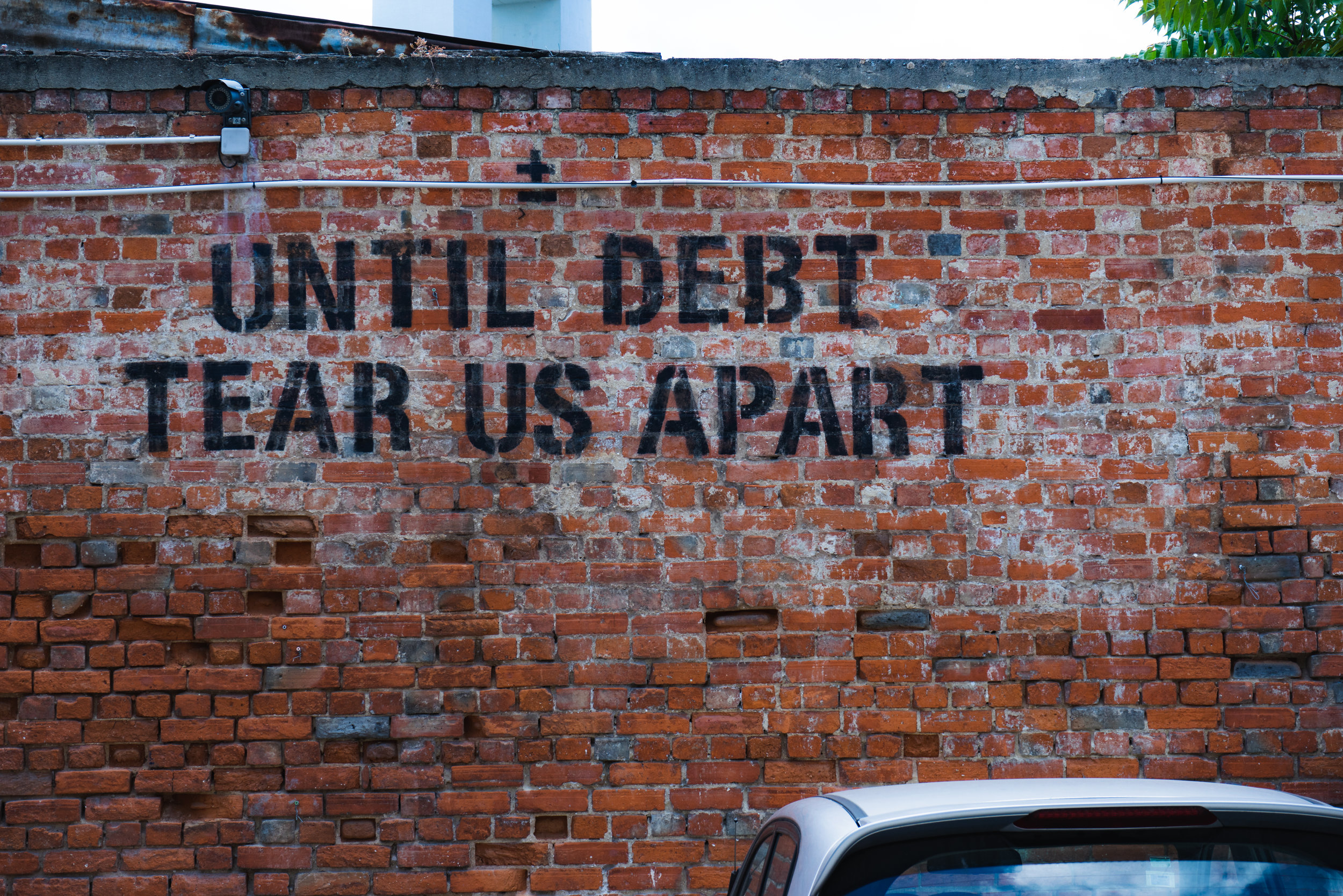

Debt is a financial product, and just like any financial product, it can get you into trouble if you use it poorly

Hello, all! Alyssa here. As you know, I’m currently taking a six-week hiatus to spend time with my newborn baby whom you’d all obviously love. Fortunately, for both myself and for my readers, I have some awesome female friends who love money just as much as we do and they’ve willingly shared some of their favourite blog posts. This week, my squirrelfran Des from Half Banked, has generously shared her personal story about debt and how she changed her expectations.If you’d like to still chat with me (even though I’m not as cool as Des), you can join me on Twitter or Instagram for small life updates and cute pics XOXO. Now let’s get to the good stuff.

I have debt.

A few years ago that sentence would have sent me into a total tailspin. I was always so adamant about not carrying credit card debt (still am, btw) and I even bought my first car in cash. Debt was not a part of my financial life.

But right now, it is.

I’ve always avoided writing about debt before now. As someone who never had it, I much preferred to let other people tell their stories, and I didn’t feel like I had anything to add (…because I didn’t). Not to mention, every debt story I heard was a bad one, and the people telling them were so, so, so excited to be out of debt. I wasn’t going to contribute from my “I’ve never had debt” perspective, but I was happy to listen and learn from them.

Of course, going into debt, I assumed I’d feel the same way as my personal finance friends, and want to prioritize paying down debt above all else. This was my chance to experience what paying down debt was like! I was going to crush it! I was so prepared!

Paying off debt isn’t what I expected

I could never have predicted that I would be totally chill about my debt, especially given that I am an aggressively un-chill person in general, and especially when it comes to money. But against all odds, that’s been my reaction more than anything.

Having debt kind of feels the same as not having debt, which is a bit unnerving. It made me feel like maybe I was doing money wrong like maybe I missed some crucial memo that I should be panicked about this.

But the more I thought about my reaction, the more I realized that I wouldn’t be reacting this way in every situation involving debt.

The first type of debt: unplanned

For example, if I found myself with a credit card balance that was going up every month, I would not be calm about it. It would be a sign to me that something had to change ASAP, and would serve as a clear warning sign that the balance between “money coming in” and “money going out” needed to shift.

That type of debt—unplanned debt—I wouldn’t be chill about, and I think that’s most of the debt people write about trying to get out of. It makes sense, because having the support of an online community as you make those changes, and adjust your money systems, is huge.

And controversial opinion coming in hot: I think most student debt falls into this category as well.

Say what you will, but I don’t think any 18-year-old really understands what it’ll feel like to start paying off $25,000 (or more, or much more) on an entry-level salary. I think that realization, when your debt repayment kicks in after school, is definitely unplanned—as is the impact it’ll have on your money while you repay it.

So if you’re hustling to pay down credit card debt, or student loan debt, my reaction probably feels an unnerving chill, like I very much did miss a memo somewhere.

The second type of debt: planned

But not all debt happens to you. Debt is a financial product, and just like any financial product, it can get you into trouble if you use it poorly—but that doesn’t mean it’s inherently evil.

Right now, my debt is a car loan I’m sharing with The Fiance, and I feel really comfortable with our choice to use this particular financial product. We went into it with a clear, short-term payoff plan, and we’ll have the car paid off in under three years. We made sure to pay attention to the total cost first, and then figure out how that amount worked with our monthly budget and our payoff timeline.

Basically, this was an informed, planned decision to use a financial product, with a full understanding of the cost.

Do I think you can get yourself into trouble with planned debt? Yes, of course.

It’s far too easy to look at your monthly payments and think adding just one more isn’t a big deal and end up stretched beyond your limit for years thanks to long payoff periods and rising interest rates. This is not carte blanche to take on whatever debt you want as long as you plan it.

But if you plan it well, make an intentional choice to use this financial product, and stay within your means… I don’t think debt needs to be a total panic emergency.

Exactly how I’m handling my debt

That doesn’t mean I’m not excited to pay off this debt, though. I’d love to get the $500 a month back in our shared budget, and throw that towards retirement savings in my RRSPinstead—but I’m not abandoning my other goals to do it.

We made the choice to keep our payoff timeline short (and strict) as part of our debt payoff plan, and in most months, I’m comfortable with our payments being a good and realistic portion of our budget to put towards the goal of being debt free. We could have gone with much lower payments over a longer timeframe, but we didn’t—so most months, that’s all we do about the debt.

On top of that, when I have “extra” money, I put a portion of it towards the debt to accelerate our progress, save money on interest, and move up our debt-free date. For example, about 30% of my tax refund is going straight to the car loan—but notably, and obviously, that’s not 100%.

I still have other goals, and the biggest one is to build up my personal emergency fund. That’s where the bulk of my tax refund is going this year, and for the first time ever, I’ll have a fully funded emergency fund. Sure, that money could go towards debt if I wanted it to… but I don’t. Debt payoff doesn’t always have to be your sole and only priority, especially if you’re not comfortable abandoning your other financial goals.

You might be! Which is just as legitimate a choice, but it’s always going to be a personal choice.

There’s no single right way to pay off debt

Even when you’re talking about the two really standard methods of getting out of debt, the debt snowball and the debt avalanche, there’s no single “best” way or “only” way to pay off debt. Sure, mathematically, you can find the most cost-effective way, but to do that ignores that we’re human beings who feel things and have thoughts that aren’t “maximize efficiency at all costs.”

Could I potentially save some money if I threw all my savings efforts at paying off the car loan, since the interest rate on it is higher than I’ll earn on my emergency fund savings? Sure. Would I be comfortable with the plan? Heck no.

It turns out, every wishy-washy email I’ve ever sent to readers who ask me how to tackle their debt is really what I would do in real life: “It depends, and I think you should do what makes you most comfortable, while still paying it off in a reasonable-to-fast way. Oh and don’t cut out your entire fun budget.”

Sure, there are some basics, with unplanned or planned debt, including:

-

Understand how much your debt is going to cost you, and adjusting accordingly (high-interest debt is much more urgent than a line of credit with a reasonable rate, for example)

-

Figure out how it fits into your financial priorities

-

Make a plan to pay it off, and stick to it

-

Understand how much you’ll save by paying it off early, and do that when you can

But if you’re doing all those things, and feeling like you missed the “panic” memo?

Don’t. It is possible to have debt, manage it, pay it off on a reasonable timeline, and not let it become your sole financial focus.

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.