Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

It’s crucial to analyze your spending every month

COVID-19 has caused many changes in our day-to-day lives. Working from home, social distancing, and exclusively shopping online has not only changed the way we live but has drastically changed how we spend our money. Maybe you find yourself saving more than you ever have. Or, perhaps you find yourself thinking this only to overcompensate with online shopping most of those savings away and more.

Personally, at the start of all this, it was hard to see a day go by without a visit from my local FedEx or Canada Post truck. With so little to look forward to, there was nothing quite like the rush of getting a shiny new package in the mail.

Is it just me? It felt like I was saving so much by staying home that my usual guards were down. A few months from now, I can only assume there will be a few ‘what was I thinking?!’ moments. With three months of this new ‘normal’ behind us, I wanted to analyze my spending and see if I was increasing my savings.

How do I budget my money?

Every month I go through my finances and analyze them for self-assurance and divide up living expenses with my boyfriend. I make sure I recognize every purchase on my credit card and have received all incoming money that I was expecting – through returns, paychecks, and e-transfers. I assign each purchase to a category and compare the category totals to a predetermined goal.

As mentioned previously, I budget mainly for information purposes, not strict limits. I realize how fortunate I am to not be living paycheck to paycheck. Currently, I have no consumer debt, student loan debt, or a mortgage to pay off. I am also not saving up for any big purchases like vacations (thanks COVID), or property. Otherwise, I would be much stricter with myself and my budget.

That doesn’t mean, however, that I’m not mindful of my purchases. I rarely buy clothes or luxury items, and I use the ‘wait and see’ rule for something that I want. I try to avoid making any spontaneous purchases, and if I still want something after a full week has passed, then I know it’s worth getting.

If you are paying off debt or not, I highly recommend the exercise of going through your spending frequently for your understanding. I download my monthly statement from my online banking into an Excel spreadsheet and analyze it with a tab labelled for every month.

What is my current financial reality?

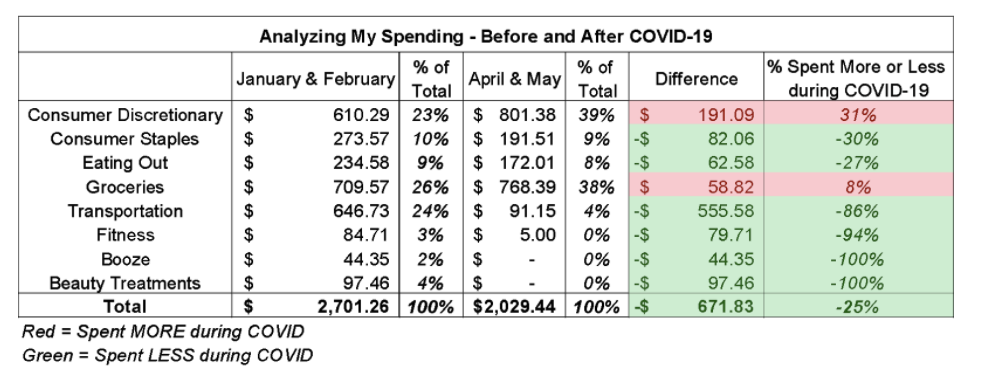

I decided to analyze my cumulative spending in January and February 2020. From there, I’d compare my spending in April and May 2020 – in the thick of lockdown. March was when all of this started here in Canada, so I felt it didn’t fully represent either extreme.

I used eight categories to compare my variable costs across the two time periods. Some fixed items for me, like rent and streaming subscriptions, were not included because they are the same throughout both periods. I also chose to keep out one-time purchases, like birthday gifts, as they are outliers from my usual spending.

Here are the categories:

1) Consumer discretionary (wants): Clothes, skincare, makeup

2) Consumer staples (needs): Cleaning products, cat food, home products

3) Eating out: UberEats, coffee, restaurants

4) Groceries: Meal delivery service, regular groceries

5) Transportation: Gas, car insurance, Uber, transit, parking

6) Fitness: Yoga classes, gym membership

7) Booze: Drinks out, LCBO

8) Beauty treatments: Haircuts, highlights, nails

What did I learn when reviewing my spending habits?

I want to start by saying that I believe increased transparency with money is a good thing. Through no fault of our own, women often suffer from the ‘money taboo’ – the notion of being uncomfortable or embarrassed to talk about our finances. Society has told us that talking about money is seen as impolite or “unfeminine.”

This phenomenon has had many negative consequences for women’s issues, such as the persistent gender wage gap. Did you know full-time working women in Canada make only 0.75 cents compared to their male counterparts? This gap is even wider for women of colour, those living with a disability, or immigrants.

How are we supposed to negotiate for ourselves at the table if we aren’t confident about the subject matter? Or we don’t have any notion of what is fair? Regardless of these statistics, the more open we are about how we earn and spend our money, the more we can seek equality for all women.

What are the key takeaways I’ve learned during the 2020 global pandemic?

1. COVID has drastically reduced my spending

I have lowered my expenses by 25% or over $650 between the two time periods. Yearly, that increases my savings to approx. $4000. That would be a substantial contribution to my TFSA account every year.

2. As expected, my consumer discretionary spending or “wants” had increased

Non-essentials were the main category that cut into my savings. What used to make up 23% of my spending now made up 39%. There may have been a few questionable purchases – an at-home lash lifting kit among them. However, since there was nothing “normal” about the last few months, I am not going to be hard on myself for a few things that brought me joy. I realize how fortunate I am to say this.

3. I broke even on food – eating out and groceries combined.

What was saved from not buying out lunch or coffee was spent on quality groceries. My boyfriend and I switched to shopping at a specialty grocery store because they offered same-day curbside pickup. This was something that we valued and were willing to spend the money on.

4. The biggest shock for me was how much I saved on transportation.

Realistically, I kept even more since the money spent on gas in May is still sitting in my tank. My transportation costs used to account for 24% of spending, closely following the top category of groceries at 26%. This was very eye-opening as a new regular driver. Based on these findings, I’m valuing my work-from-home situation even more.

5. A portion of the transportation costs was also saved on insurance.

I was able to negotiate with my insurance company to pay 75% less on insurance if I park my car and don’t drive it. This hasn’t been an issue so far and a straightforward way to save.

6. With gyms, yoga studios, and salons closed, that saved me a small but insignificant amount of money.

If you go to more high-end gyms and salons, this could be a substantial decrease for you.

Why you should consider looking at your current financial situation

I would highly recommend this exercise for anyone, especially those that want to improve their economic well-being. It’s crucial to analyze your spending every month for your knowledge and budgeting goals. Only then can you see potential detrimental spending behaviour and how it can be improved.

This exercise provided me with a lot of eye-opening information. I would never have realized that by staying home to work, I’d be saving approximately $2,750/year. If I request to work from home sometimes, whenever we return to some normalcy, that is a substantial pay raise in my pocket that my boss is unknowingly providing me. For my fellow commuters, that could be a conversation worth having, not to mention the opportunity cost of the time saved in traffic.

Analyzing my finances also allowed me to reflect on whether I valued the instinctive purchases I was making before and assess whether I wanted to continue them going forward. After three months of at-home workouts, do I really need to be spending $20 per class at a gym? I think I’ll be going less due to the accessibility and convenience of working out at home. Maybe you’ll make similar realizations, or perhaps you’ve missed your memberships and are looking forward to returning. At least now you can rationalize every purchase and know that it’s money worth spending.

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.