Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

Is one market better than the other?

Everyone and their uncle seem to have a strong but differing opinion on whether it’s worth investing in real estate or the stock market. With each person comes a different view on which “hot” market will win big and be the catalyst of your financial future. Although everyone has their own opinion, it’s important to base your decisions on facts and not personal experience.

I recently got into a conversation with a family member in the real estate business who was considering getting out of the stock market entirely due to their perceived notion that they were getting a lesser rate of return. Through my financial knowledge and work in the industry, I had opposing views; however, I knew that they were incomplete and potentially biased.

I knew that my parents’ generation had done tremendously well investing in real estate in Canada; however, were previous generations so lucky? What is the outlook for the future? Surely, we can’t keep seeing the same returns, given that my whole generation is getting priced out of the market.

After this conversation, I decided to seek answers to the question myself – is one market better than the other? And when is either one more appropriate?

First, I felt it was important to look at a historical breakdown of the returns going back several generations.

What is the historical rate of return in the stock market?

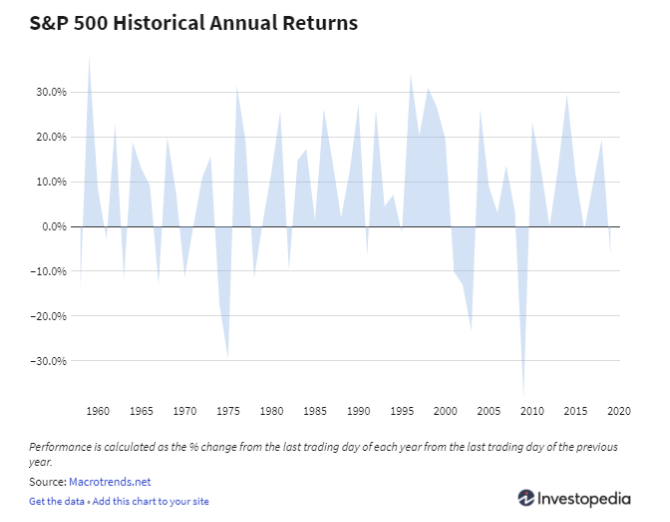

Although there is an infinite amount of financial investment tools to analyze, to get a picture of the overall market performance, I looked at the annual returns of the S&P 500. The S&P 500 incorporates 500 of the US’s largest companies – and has since 1926. It represents a comprehensive picture of the stock market and the overall economy. Since formation, it has returned 7% (adjusted for inflation) on average annually, and over the last ten years, it has returned 13.5% annually (including dividends, but not accounting for inflation).

Since no investor can hold stock in the S&P 500, to realize these returns, you need to invest in an exchange-traded fund (ETF) mirroring the S&P 500. These ETFs track the holdings of the S&P 500 and try to mimic their returns. If investors want their money to perform at the same rate as the market, they can invest in these ETFs for a fee called the ‘Management Expense Ratio’ (MER). An example of such an ETF is the SPDR S&P 500 (ticker SPY) with a MER of 0.09% annually. You deduct this cost from the overall returns.

Although these average returns represent a favourable picture for the stock market, it is essential to note that most investors don’t realize these returns in full due to volatility, fees, and inadequate due diligence when selecting investments.

What is the historical rate of return in the Canadian real estate market?

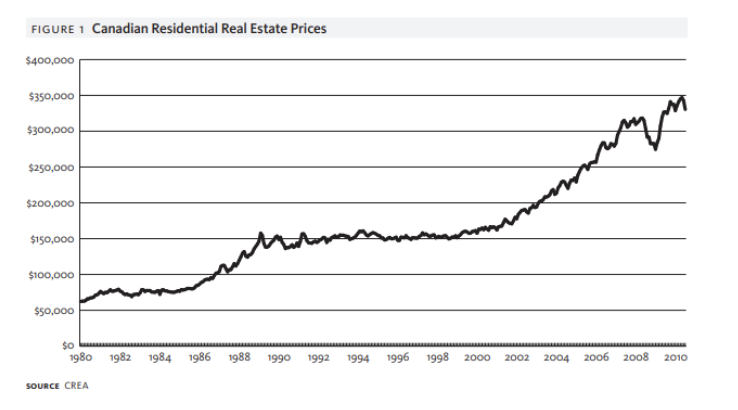

It is no hidden secret that Canadian housing prices have soared in the last 20 years. To buy a home in the Greater Toronto Area in 2019 would cost you roughly $850,000, up 140% from approximately $350,000 in 2000. This example is similar to my parents’ situation who purchased our semi-detached family home in central Toronto a little over twenty years ago for $200,000. Its current value is now over $1.2M. On the one hand, I’m happy that they were able to realize these returns, but on the other, I’m sad knowing that I will likely not be able to raise a family in the city I grew up in.

Across the country, appreciating real estate values were seen over the same period, though to a lesser extent, with National housing prices rising 87% in real terms between 2005 and 2016. That is an increase of 7.25% annually. These returns are slightly above the 7% average annual return since inception of the S&P 500, but less than the performance seen over the last ten years.

These crazy real estate prices were not always the case in Canada. As ‘Figure 1 – Canadian Residential Real Estate Prices’ shows, prices grew steadily between 1980 to 2000 with two lengthy plateaus during the ’80s and ‘90s with housing prices averaging $75,000 and $150,000. Although that is a 100% increase over the 20 years, it is still very little compared to the 333% increase over the last 20 years, with an average home price now sitting at $500,000.

What does this data mean to us today?

From this data, we can conclude that both have done similarly very well over the last ten years, but I think it would shock people to know that Canadian real estate returns have underperformed the S&P 500.

Psychologically, people remember negative events more than positive ones. In other words, losing $100 generates more powerful emotions than gaining $100. Real estate may be viewed more favourably due to this phenomenon since, unlike the stock market, you are unable to see the value of your home go up and down every day.

I believe that both the stock market and real estate market serve a purpose; however, as a millennial dealing with unrealistic housing prices, it’s nice to know that I’m not jeopardizing my financial future by continuing to rent and investing my savings in the stock market.

What are the pros and cons of each investment opportunity?

Before you invest, it’s important to evaluate more than just historical returns. As I mentioned before, both markets serve a purpose and help you reach your financial goals.

Where you choose to invest your money depends on the amount you have, your risk tolerance, whether you need quick access to the money, and the amount of time and energy you are willing to put in.

For a breakdown of these differences, here are the pros and cons to both options:

|

Investing in the Stock Market |

|

|

PROS |

|

|

Capital Requirements: |

|

|

Low Maintenance: |

|

|

Strong Historical Performance: |

|

|

Liquidity (Money Accessibility): |

|

|

CONS |

|

|

Volatility & Risk: |

|

|

Taxes: |

|

|

Investing in the Real Estate Market |

|

|

PROS |

|

|

Stability: |

|

|

Canadian Real Estate Trends: |

|

|

Accommodation: |

|

|

Taxes: |

|

|

CONS |

|

|

Capital Requirements: |

|

|

High Maintenance: |

|

|

Liquidity (Money Accessibility): |

|

What about Real Estate Investment Trusts (REITs)?

I feel that this article wouldn’t be complete without touching on the investment tool called a REIT. You can view this tool as a combination of the two types of investments. Like any other stock, REITs are listed on a stock exchange for a per-unit purchase price. They grant individuals the ability to invest in real estate by pooling people’s money to buy a wide selection of assets.

There are different REITs for different real estate properties, such as long-term care facilities, commercial properties, and healthcare facilities, to name a few. Investors of REITs generate income through the scheduled distributions. These distributions include money earned from capital gains, rent, and other income streams that would be involved if you purchased property yourself. They are similar to dividends in that they are scheduled on a monthly or quarterly basis but are taxed differently depending on the breakdown of how the income was earned.

PROS.

-

You are still invested in the real estate market

-

Requires little capital to invest

-

Low maintenance as you are not a landlord

-

Stable cash flows through the distributions

-

Liquidity or easy access to money

CONS.

-

Low growth or capital gains opportunity compared to regular stocks

-

Distributions are taxed at a higher rate

-

Potential for volatility

-

Higher management fees

So, is one truly better than the other? No. Both have different characteristics and can be used simultaneously to meet your financial goals. Real estate should not replace your other investments. They cannot offer the liquidity, retirement savings opportunities, and tax benefits (if you are investing in multiple properties) that financial investment tools can. Also, contrary to popular belief, they have returned more on an average annualized basis.

This is an important point to make as millennials may feel discouraged or pressured to enter the real estate market too soon. The psychological burden of having a mortgage you can’t afford is not worth the perceived benefits. The stock market can seem daunting, especially given this year, but know that with every downturn in history, the stock market has rebounded and returned more for investors. Continuing to rent until you are ready while investing your savings in the stock market, is one of the best financial decisions you can make.

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.