Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

That loneliness can become costly

Once upon a time some 62 days ago (to be exact), my husband and I picked up our lives and moved 7 hours up north to a new city. I know, I know, you’ve already heard this story several times. But what you haven’t heard is my current feelings about completely changing my lifestyle and social life.

It’s been hard.

I’m used to living in a city where I’ve established myself, made some lifelong friends, been a 15-minute drive from my siblings, and had the ability to participate in any hobby or sport with ease.

Now I’m living in a place where I know less than five people, and going out and exploring or running by myself seems… scary.

We’ve all been there. Whether we’re in a safe place, a new space, or on a fun adventure. We get lonely.

The only difference from any other time I’ve been lonely is that this time it’s costing me more than a few dollars.

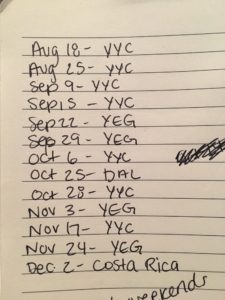

You see, from the day we moved here until the first weekend in December — there are 18 weekends. I will be in Fort McMurray for 5 out of those 18 weekends. Less than half of my weekends will be spent not travelling to cities that hold close friendships or family members.

Of the 5 weekends I’ll be spending in Fort McMurray though, only 50% of those will be spent without a visitor.

I’ve literally filled my entire schedule with comfortable places to support my current state of loneliness. Which sounds crazy.

I mean, when I mapped out these numbers, I was SHOOK. Normally, I’m thrilled to spend time alone and to relax. But it seems that part of me is long gone.

The worst part of it all? I now haven’t rested (because I’ve been constantly travelling), so I felt it was necessary to spend money on a night just to relax so I can “de-stress”. Dinner, hockey game, and fancy hotel. WHO HAVE I BECOME?

You don’t have to move to be lonely.

Admitting that I’ve been overspending on my entertainment and vacation budget because I’ve been travelling to keep myself happy is kind of embarrassing — but I also know that feeling lonely doesn’t always come from where you live.

Some people feel lonely in their very own cities, and in their very own lives. That loneliness can become costly.

In just two months, I’ve already spent an additional $1073.28 on being lonely.

That includes gas to drive, plane tickets, dining out, social outings, and small purchases. Every single one of those expenses were spent because I felt I was missing something.

The feeling of missing something is one of the easiest ways to lose financial control.

When we’re feeling excluded, upset, and bored — we spend to feel the opposite. Being lonely is one of the worst feelings’ in the world, but being over budget is one of the worst realizations.

So, how can we stop the cycle?

-

Get involved in your community (new or old)

-

Find free events that appeal to your interests

-

Meet new people by joining a sports team or club

-

Put yourself out there by taking risks

But most importantly — let yourself feel what you feel.

Pretending that I’m not lonely by spending a ton of money on trips isn’t going to stop the loneliness. It always feels great to see friends and family, but the hole is still there once I get home.

Admitting how you feel can be super hard, but it’s always the first step to getting the rest of the spin cycles moving.

A couple of my good friends even mentioned that it’s best to schedule time at a coffee shop so that you’re around people more often, or to schedule Skype calls to feel more connected. (Thanks Andrew & Des)!

Being lonely is only temporary — so don’t let those poor financial habits that coincide with loneliness become permanent.

What do you normally do when you’re feeling lonely? Have you ever spent money to make yourself feel closer to home? Let me know in the comments!

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.