Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

we were willing to sacrifice a lot of time and freedom to achieve our financial goals

Budgeting your money can be, hm, what’s the word I’m looking for? Oh right. Awful. It can be awful. Budgeting your money for a baby? Way less awful. Mostly because it’s exciting to start your planning and preparation to enjoy a financially successful time as new parents. But also because you know exactly how long you’ll have to achieve the perfect budget and savings goal. Although most people will tell you it’s impossible to predict how much a baby will cost or all that will be required during your pregnancy and first few months, the best thing you can do is to try everything possible to prepare. Three weeks ago I announced my pregnancy, two weeks ago I touched on why we kept it a secret for eight months, and last week I gave you a list of every single thing we have bought before the baby arrives. I’m now just five days away from my due date and totally and completely unprepared to be a mother. Well, except for financially. Financially, I feel confident — and that’s because we made the perfect budget for our baby.

What did we budget for?

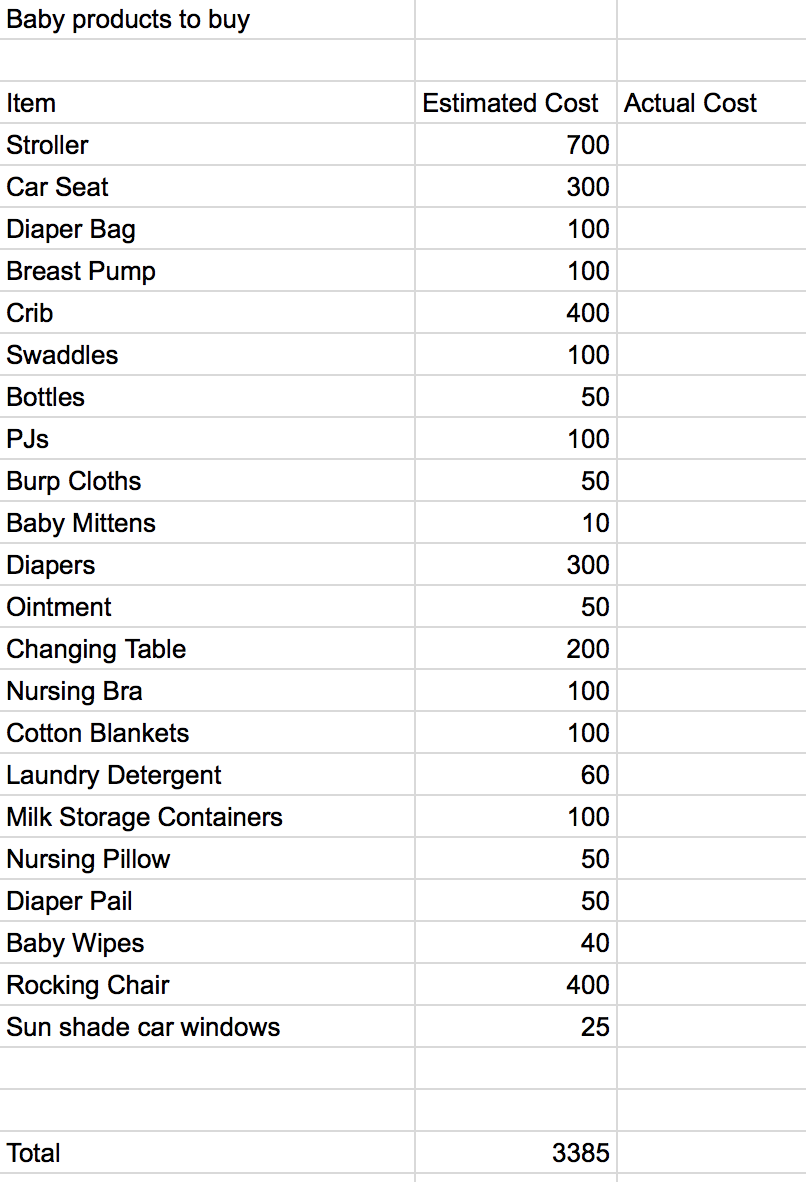

Initially, when my husband and I sat down, I made the most generic list of everything I thought we’d need at that point. When I did this, I was about 14 weeks pregnant and still digesting the news. I went back to check out the spreadsheet just five months later so that I could start to develop my full list of items we bought for our newborn, and I was shockingly pretty impressed. Although the actual products included and the estimated costs were random guesses, I only managed to be off by a couple hundred dollars.

Based on that chart, I decided to be on the safe side that we should assume we’d spend $5,000 before the baby arrived and that it would be ideal to save $10,000 for the entire first year as new parents, to supplement diaper needs and also support any necessary purchases that we’d otherwise be stressed about due to the decrease in income. Fortunately, I am able to take a full year of financially-supported maternity leave that is covered by the Canadian government.

During that time, my husband will continue to work. However, we also lucked out in the fact that he has June 15th to mid-August off of his current contract before signing on as a permanent employee. Therefore, we’ll be able to enjoy the first three months of parenthood as a team — which is very rare. But what this great news also meant is that because we would both be off for the summer, we’d also need to save an additional amount to supplement a lack of income. To do so, we also saved for this expense over the past eight months. Our grand total savings goal was approximately $25,000 — because we are seriously becoming overachievers.

In other words, we had three separate savings accounts and financial goals to hit by May. In total, we planned to save around 27% of our combined income towards becoming parents, while still saving for our other financial goals such as retirement, a down payment and travel. We had from October to November to complete these goals.

How did we save the money?

The first thing we did was open a high-interest joint savings account. Every paycheck, we would pay our bills, wait for our automatic transfers to go towards other financial goals, and then we’d see what was left. Basically, whatever was left went directly into the family fund. During this time, my husband was working two jobs at around 60 hours per week and I was also working two jobs at around 50 hours per week. No, this is not me bragging about how hard-working us gosh-darn millennials are. This is me saying that we were willing to sacrifice a lot of time and freedom to achieve our financial goals and to explain how we could save such a vast amount of money in such a short amount of time. We were very fortunate to be able to find two jobs a piece. Does this type of lifestyle work for everyone? No. Is this type of lifestyle an option for everyone? No.

However, there are three things we did to save this money that might work for you:

1. Stop saving for other goals that are no longer important

I was saving a lot of money towards future trips and plans that were no longer going to be possible due to my pregnancy — such as bachelorette parties and an upcoming trip to Costa Rica — that we, unfortunately, had to cancel. However, on the bright side of things, this meant that I could put any of those savings towards the baby fund and save a ton of money and time. Having a baby dramatically changes your life and although you may think you’re not financially equipped to prepare for such a new event, you’ll also be surprised to see a quick change in your priorities. Perhaps you had $1,000 saved for a trip over the summer that you might now be able to put towards your baby budget instead.

2. Flip your typical spending habits to reflect newer needs

The not-so-great part of pregnancy is that you are suddenly required to avoid some of your favourite things. However, those not-so-great parts can become extremely great for your bank account. Rather than spend a ton of money on drinks with friends, on fancy dinners with food you “shouldn’t” eat and on a women’s soccer team fee that won’t be used — you suddenly use that money for other costs. Turns out, prenatal vitamins are pretty costly considering how often you run out. You may also need to splurge on some maternity clothes and health classes. Don’t forget that it’s not just the baby that you’re saving for. By using the money you usually spent on entertainment on your pregnancy, you avoid having to go over budget and continue to live almost the same lifestyle throughout the next nine months.

3. Don’t buy anything until after your baby shower

To avoid spending the full estimated $5,000 we figured we’d need before the baby came, we decided to wait until after the baby shower before buying all the gear. I knew everything that I would need for baby and want for the baby because I threw everything onto the registry long before we sent out invitations. Then, once a week I would go and check for sales to see if there was anything I should go ahead and purchase before the day arrived. Otherwise, I would leave the list there and hold my breath — which was honestly the hardest part of my entire pregnancy. I wanted to know what I needed and I wanted to see it right now. However, the wait was worth it. We received plenty of great items and hand-me-downs at our baby shower, and the next day I went through my registry and purchased everything that was left. For anyone wondering, I decided to use Babylist for my registry as you could put items from multiple stores on your list and they also had an awesome tool where you could add directly from any website to your registry.

To create the perfect budget for your baby, I recommend deciding your goals and then determining how best to save for those goals. But — every single person’s situation and needs will be different. The only thing that’s constant is that it’s expensive. According to Money Sense, It costs roughly $14,350 per year to raise a child in Canada. But I’ll have to get back to you on the reality of an Albertan personal finance nerd who seriously hates spending money before I can determine the facts.

I’m ready to take a mini-maternity leave from blogging

At the end of the day, pregnancy has been great. But it’s also been exhausting. During the past nine months, I started a new job, tried my best to work at my side job, and also continued to blog. I finally burnt out about well, right now — as I write this last and final blog post until I take a six-week hiatus from writing. To be honest, I know I’m going to miss my job and my boss — who has been extremely supportive throughout the entire pregnancy — however, I’m sure these next 12 months spent with my bigger-little family will be absolutely wonderful.

If you’re wondering whether the blog will still have content and posts coming out each week you have nothing to fear. Some of my amazing female blogging friends have jumped on board to help out and supplied me with some of their favourite and always-empowering financial content that I’m sure you’ll love. As of now, I plan to be back with a life update and some, I’m sure, hilarious stories by July 3rd. Until then, I’ll still be on Twitter with some occasional 140-character updates and on Instagram with some super-adorable pictures. Feel free to follow along.

Let me know if you have any advice or stories to share in the comments. XOXO! See you in six weeks.

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.