Mixed Up Money

There is never a bad time to start learning about money Modern technology makes it easier than ever to access information. Forget university courses and textbooks. You can find a wealth of information that’s much more specific and relevant to your chosen topic online. Sometimes I think that my business degree at university prepared me […]

doing something small can tackle something even larger that has been holding you back It’s that time of year again, where we all hibernate into our homes and bundle up in front of the fireplace. We eat more cookies than we can count, and we forget about all of our responsibilities for just a few […]

are you still watching? One of the expenses I’ll never be able to cut out of my budget is Netflix. It’s honestly become a part of my weekly routine. It’s my most justified monthly cost because it allows me to disconnect and watch my favourite shows on my own time, without commercials, at an affordable […]

you need to be open to tweaking your budget every month if your circumstances call for it Hello, all! It’s finally the last time you’ll have to read this italicized introduction about how I’m still on my six-week blogging maternity leave. Fortunately, for both myself and for my readers, I have some awesome female friends […]

Standards of beauty are enforced by Hollywood and by pornography Hello, all! Alyssa here. Week five of me and my child pretending we have any idea what we’re doing and obviously we are loving it, but really miss you guys! Fortunately, for both myself and for my readers, I have some awesome female friends who […]

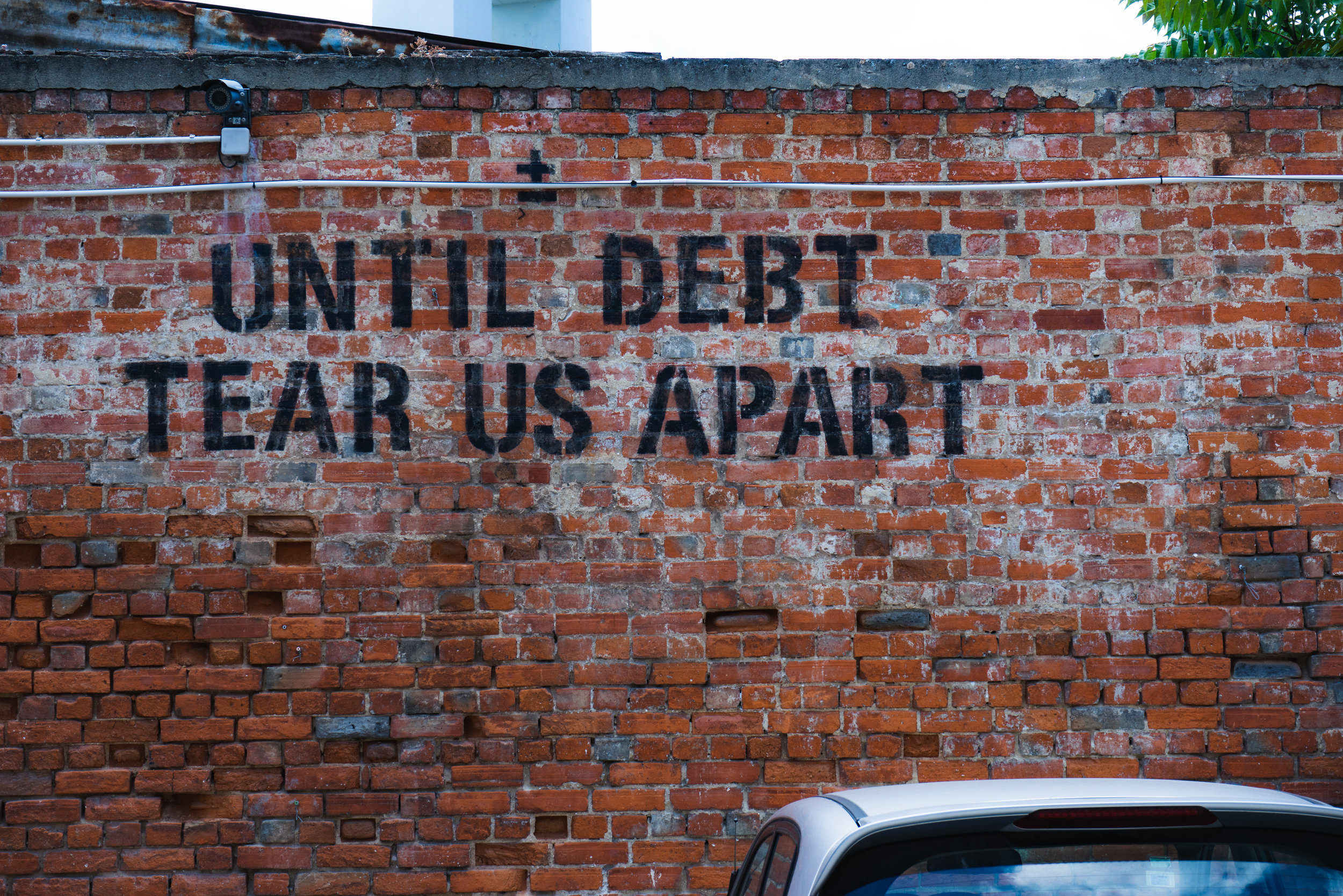

Debt is a financial product, and just like any financial product, it can get you into trouble if you use it poorly Hello, all! Alyssa here. As you know, I’m currently taking a six-week hiatus to spend time with my newborn baby whom you’d all obviously love. Fortunately, for both myself and for my readers, […]

We all know the solution is an emergency fund, okay guys? Nothing says money advice quite like skipping the 45 minutes you usually spend wading through a 1,500-word blog post about someone who was charged an extra $500 for their utility bill. We all know the solution is an emergency fund, okay guys? We all […]

She is the founder of the two-time award-winning Canadian Personal Finance Blog of the Year, Mixed Up Money which has over 100,000 followers across social media. Through her work, she has been featured in many notable publications, including The Globe and Mail, CNBC, CBC, and more. Her books, The 100 Day Financial Goal Journal and Financial First Aid are currently available for purchase.

Alyssa is a freelance writer and enjoys writing about personal finance, homeownership, and more. When she’s not writing, you can find her enjoying some downtime with her kids, playing soccer or daydreaming about home decor.

Alyssa Davies is a content manager for Zolo, Trauma of Money facilitator and a published author living in Calgary, Alberta.

I'm Alyssa! Welcome to my corner of the internet!

Meet Our Founder

This one's on me. Complimentary free stuff coming right up.

leaving so soon?

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.