Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

once companies are at the stage in their business to consider going public, they have to choose how

“Have you ever heard of a SPAC?” This was the question that I asked my online community, and not surprisingly, a large majority had never heard the term before. For me, the word SPAC or Special Purpose Acquisition Company first came up in 2017 and had fallen off my radar until coming up again last year.

In 2017, I was working at a co-op job in downtown Toronto at a financial company. The company had many moving parts, and I worked exclusively with one side of the business. I didn’t know what my other colleagues were doing until near the end of term when I finally got a peek inside after being ushered into a board room.

I grasped that one side of the business was a SPAC and had just finalized a deal, which was cause for major celebration. I didn’t understand much, only that this was big news and an excellent step for the company. I left the board room thinking that this was some private deal for a few big-name investors, utterly unaware that public investors, those like you and me, would be benefiting from this news as well.

Fast forward three years later, and it was my boyfriend who brought them up again. They were on Reddit, his favourite financial news platform. This is unsurprising as 2020 was the most significant year for SPACs in history. His excitement was a big inspiration for why I wanted to learn more.

A SPAC is not an investment

The first thing to know is that a SPAC is not an investment. It’s a legal structure. It’s one of three ways that companies can go public, or in other words, get listed on a stock exchange. Some benefits to going public for companies is that their company gets valued, as shown through the stock price, they have easier access to capital or outside investment to grow their business, and there is increased liquidity for investors. There is also credibility that comes with going public – it’s a milestone that the world’s largest, and arguably most successful, businesses have all taken.

Why a traditional IPO can be problematic

So, once companies decide that they are at the stage in their business life cycle to consider going public, they have to choose how. Like I mentioned, there are currently three ways to do so – a traditional IPO, a direct listing (a less popular option that I won’t go into here), and a SPAC.

The typical route is through a traditional Initial Public Offering (or IPO).

SPACs have taken off due to the challenges that arise for both companies and everyday investors with the traditional process. The company will work with an investment bank, otherwise known as the underwriter, that comes up with a price.

As a company, you receive the deal price determined by the underwriters, and they technically own the stock on that first day of trading and receive the price sold to the public. This is a challenge for companies because IPOs have historically been underpriced by banks that want to create demand for the stock. It creates a conflict of interest because companies benefit from a higher price, and underwriters benefit from a lower price.

In addition to this, it’s nearly impossible to get stock of an IPO as an everyday investor. This is normally reserved for institutions and the bank’s most profitable clients.

What is a Special Purpose Acquisition Company (SPAC)?

SPACs have been around for a few decades but have only gained popularity recently. Using a SPAC provides advantages for companies because it eliminates that conflict of interest with the underwriters and costs much less.

In 2020, 200 SPACs went public. That’s six more than traditional IPOs and raised only $3 million less, at $64 billion. SPACs have become famous for tech and innovation companies – from industries such as electric vehicles, space exploration, e-sports, and online gambling. You may know some of the more popular companies that went public using a SPAC recently, including Virgin Galactic, DraftKings, Opendoor and Nikola Motor co.

A SPAC is a company that has gone public on its own, with a unique exchange-traded ticker symbol. For example, SBUX is Starbucks’ ticker symbol and trades on the NASDAQ exchange. A SPAC has no business operations, and its sole purpose of existence is to find an operating company hoping to go public to merge with. This can be called a “reverse merger.”

The company they acquire eventually takes over their spot on the stock exchange, and those that initially created the SPAC essentially bow out after the deal.

They benefit by keeping a portion of the shares, usually around 20%. The companies benefit because they didn’t have to go through the lengthy process of going public, avoided underwriter fees, and potentially underpricing their stock.

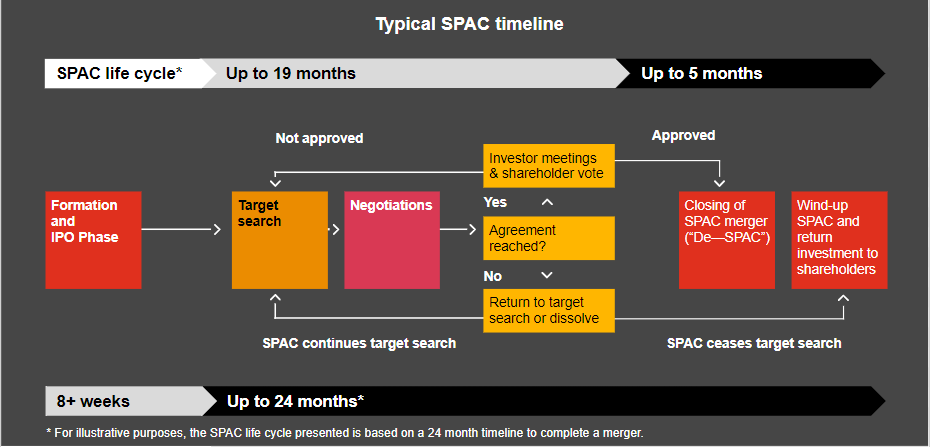

What is the life cycle of a SPAC?

1) SPAC creation

Once created, a SPAC promoter has up to two years to find a company to merge with. Around 20% of the SPAC shares are held with the promotors, but the remaining 80% can be sold to the public. When someone invests, their money is placed in an interest-earning trust until a deal can be made or the SPAC is wound up.

SPACs begin trading at $10 a unit, their starting Net Asset Value (NAV) – which consists of one share and any number of warrants that can convert into shares at a later date. Warrants give investors the right to buy stock in the future at a fixed price (typically $11.50) – making them highly valuable if the stock goes up.

For example, if the stock is now trading at $20 and you have the option of buying them at $11.50, you’ve instantly made an $8.50 gain per share.

The shares have a money-back guarantee of their NAV, which may decrease over the two years as the company spends money trying to find a target. This money-back option is the reason why some investors claim that buying SPACs is “risk-free.” I would disagree with this statement, but it’s a compelling feature and does lower your risk.

2) Deal negotiations

Once a SPAC has found a “target,” negotiations will begin to reach an agreement. Only members of the original SPAC creation and the company are a part of these negotiations. Both sides must see a good fit. Typically, the SPAC members will focus on companies in their specialties. If they cannot agree, the SPAC can go back to searching if the time frame is not up yet.

Sometimes during this negotiation stage, news of a potential announcement can trigger major price moves if there is a lot of press and excitement about the potential target company.

If you agree, the SPAC heads to an investor meeting where all shareholders have the opportunity to vote. A majority need to decide, and shareholders that don’t agree have the chance to sell out. If everything passes, the “de-SPAC” process starts.

3a) Merging with a company (The de-SPAC)

At this point, there was a successful agreement, and both companies begin transitioning. The company becomes the SPAC and starts trading in its place on the stock exchange. The share price will now reflect the value of the new company, depending on their performance numbers and estimates for the future. If both look positive, the stock has the potential to rise significantly above the original $10. This appreciation potential is the main reason why investors choose SPACs.

At this point, investors can decide to stay for the long-term if they believe in the new company or sell out and take their gains. Remember, they also can exercise their warrants, which is a significant advantage if the stock price has risen.

3b) Wind-up

If the SPAC fails to acquire a company during the two years, they will have to wind up. In this case, they will return the money to investors at the current NAV.

What are the benefits of SPACs for investors?

Some significant benefits make SPACs unique and appealing to investors. The first being the exposure to new companies. It’s nearly impossible to receive traditional IPO shares on the first day of trading and participate in the “IPO pop,” the standard rise in price on their first day. With a SPAC, every day investors can take part.

There is also the benefit of the warrant received when you purchase units. This is not something you get as a traditional shareholder. It has lucrative potential and can also be sold separately from your shares.

Finally, the money-back guarantee doesn’t eliminate risk, but it does reduce it and provides a cushion that doesn’t exist anywhere else.

Potential problems or risks of SPACs

There are some potential problems with SPACs being on the rise. With a historical amount being created, it becomes increasingly more challenging to find a suitable target company.

With a smaller ratio of potential companies to SPACs, these companies have all the bargaining power, with four or five teams’ options to choose from. There is also the potential for worse deals as SPACs become more desperate to close a deal.

What do we think of SPACs?

SPACs have provided a new option for companies wishing to go public. They avoid some of the issues with the traditional process and give companies the opportunity they may not have had before. These are companies with little cash flow but significant growth potential. That’s why you see recent newsworthy SPACs in innovative industries like space exploration and e-sports.

It’s important to note that these are speculative investments that are typically not for long-term use. They should not make up the bulk of your portfolio by any means. They require constant active management. Monitoring the news allows you to know of any deal announcements.

Otherwise, you are left in a position where a majority of shareholders already sold their positions, leaving you behind.

I find that with many buzzworthy finance topics, it often means that a lot of the gains have been realized. In other words, the train has left the station. I’m not sure if that is the case for SPACs, but I’ll indeed be watching them closely over this next year.

TL;DR? We’ve got you!

-

SPACs are not an investment. They are a legal structure

-

SPACs offer companies a new way to go public and list on a stock exchange

-

SPACs had their largest year ever in 2020, passing the filed number of traditional IPOs

-

Some popular companies that used a SPAC to go public include Virgin Galactic, DraftKings, Opendoor and Nikola Motor co.

-

A SPAC is a shell company that lists on a stock exchange purely to find a legitimate business to merge with within a two-year time-frame

-

Investors buy a SPAC in anticipation of a deal and can get a portion of their money back if no agreement is made

-

Investors receive a unit – a share and any number of warrants when they invest

-

If a deal is made, the company takes over the SPAC, and the stock price reflects the value of the new company

-

If no deal is made, the SPAC is wound up, and money is distributed to investors

-

SPACs tend to be companies in innovative industries with little cash flow but high-growth potential

-

They are speculative investments that require detailed active management and should not make up the bulk of your portfolio

-

SPACs are having a moment right now, but there is no way of knowing what will happen in the future

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.