Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

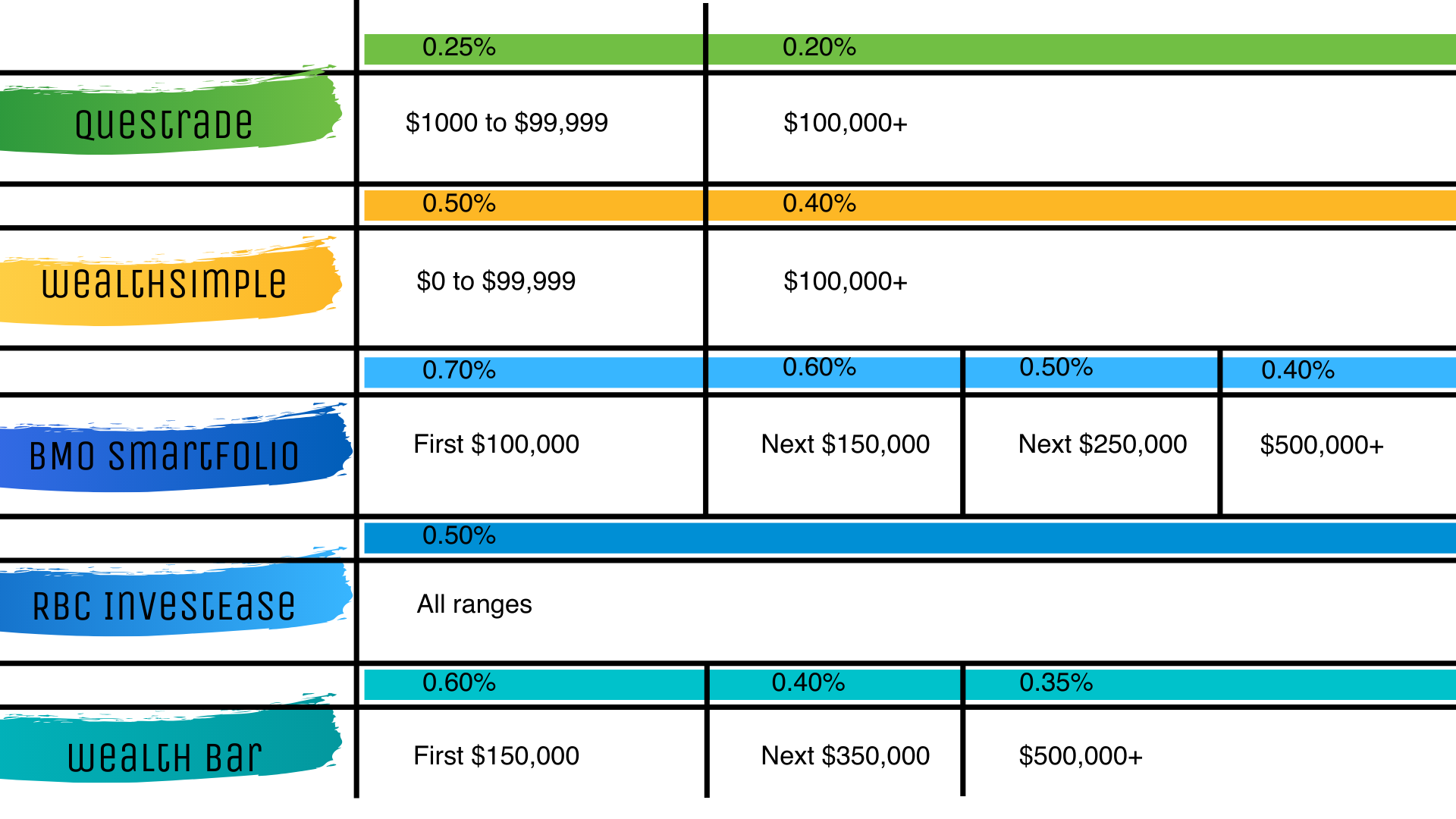

There are lower expense fees and better options for your financial future

If you haven’t started to get the tax-season itch yet, don’t worry. There is still some time before you have to get going on filing your paperwork and getting organized. In fact, you still have time to do last-minute contributions or transfers to your Registered Retirement Savings Plan (RRSP) to ensure you get a reasonable break on your taxes.

In case you’re not sure of the dates and aren’t in the mood to Google, here are some upcoming deadlines you should know of:

-

Deadline for contributions to your RRSP for 2019 tax year: March 2, 2020

-

Tax filing deadline for 2019 tax year: April 30, 2020

-

Self-employed tax filing deadline for 2019: June 15, 2020

-

Calling all keeners! The earliest you can file your tax return is February 24, 2020

Perfect. Now that we’ve gotten that cleared up, it’s time to start taking your money seriously. Tax season is usually that time of year for me. I start to take a look into my current investments, check that I’m getting a decent return, and lastly, that my money is taken care of in a respectable way. After all, it’s my hard-earned money that I’ve locked away for my future self, and how it’s managed matters a lot.

For me, switching to a low-fee, diversified Questwealth Portfolio from Questrade offered the opportunity to pay less in management fees and earn more on my money. It also gave me confidence, knowing that my retirement savings will go where they should — in my pocket, not someone else’s. Before making the switch, I had no idea how much my investments were costing me, and it wasn’t amusing to find out.

When it comes to personal finance, your number one concern is (typically) your future self and preparing for retirement. The year 2020 should be no different. From expense ratios to management fees, let’s look at what happens to your money based on where you invest.

What are management fees?

At the bare bones, management fees are the cost that you incur to have someone manage your financial investments and assets. In other words, it’s compensation for the portfolio manager’s expertise, choosing stocks and also moving around your money. Management fees typically range from 0.10% to 2% (or more) for mutual funds – and according to a 2017 report by Morningstar, Canada, unfortunately, has some of the highest mutual fund management fees in the world.

The two types of mutual fund accounts that you could have are a commission-based account and a fee-based account. If you have a commission-based account, you would pay your financial advisor through the commission’s earned through bought and sold investments. If you have a fee-based account, you would pay fees based on a fixed percentage of the overall value of your account.

A 2019 IFIC report found that nearly half of Canadian households own mutual funds, and almost two-thirds of those mutual funds are held in RRSPs. Mutual funds are a popular investment tool because they tend to be low-risk and quite diverse. However, that doesn’t mean they don’t come at a cost. Mutual funds have internal fees that are called management expense ratios or MERs, that range between 1.5% to 3.5%.

How can you find out how much you’re paying for your investments?

If you’re unsure of how much you currently pay for your investments, the simple way to find out how much you’re paying is by asking. I know, ew to adult things. But also, worth the social interaction. You can also check your paperwork or login to any account to find your percentage breakdown. Once you have those numbers, some simple math can tell you how much you pay for your investments.

Let’s look at an example:

You have a fee-based account through your bank. You currently pay 2% of the $50,000 you have invested, and you also have three mutual funds that total half of your investments value at $25,000. The mutual fund MERs cost 2.5% because wait for it – 70% of the money Canadian have in mutual funds have an average fee of over 2%. What do all of these numbers mean? Well, here is how much you pay to own these mutual funds: $1,625/year.

*mic drop*

If you’re as shocked as I was, spoiler alert: it doesn’t have to be like that. There are lower expense fees and better options for your financial future.

What should you pay for your investment fees?

An actively managed portfolio can be a good option. An excellent way to confirm that you are paying a reasonable amount if you opt to keep an advisor is to ask yourself what value you are getting. However, it’s also an excellent opportunity to consider lower-cost options that are still amazing tools for your investments.

Lower cost options include Exchange-Traded Funds (ETFs), Index Funds, and No-Load Mutual Funds. For me, a great way to keep costs low and also diversify my portfolio without having to pay for someone to actively manage my stocks was by using a controlled, pre-built Questwealth Portfolio. Why? Well, for one, they have one of the lowest management fees in Canada.

Information based on data found on company websites

Is Questrade right for you?

As someone who genuinely cares about their financial future, Questwealth Portfolios was the perfect choice for me.

But, let’s chat about whether or not they’re a good fit for you.

If you need an investment account that is easy to open, fund and invest, Questwealth Portfolios is a great option. If you’re unsure whether or not a Robo-advisor is right for your needs, one thing to consider is that they offer similar products your financial advisor can offer, but at a lower cost, so…you know. Not a bad trade-off.

Questrade offers two great ways to invest your RRSP, including managed, pre-built Questwealth Portfolios and Questrade Self-Directed Investing. Therefore, if you prefer to be hands-off or like to manage your portfolio on your own, both options are available. Just like big banks, Questrade is a member of Canadian regulatory organizations (IIROC and CIPF) that oversee operations and ensure they meet strict investment industry standards.

While most investment companies offer private insurance for your assets, Questrade goes above and beyond to provide an additional $10 million in private insurance. But my personal favourite: Questrade also offers SRI (socially responsible investing) portfolios. All this means is that you’ll only invest your money into companies that align with your values.

If you want a bit more information, you can head to their RRSP information page and learn all about their portfolio offerings.

Before the RRSP deadline quickly approaches, now might be the time to double-check your investment fees and consider where you’d like to keep your money. Better yet, if you don’t have an RRSP, now is the perfect time to transfer some of your savings into a retirement fund that can support your future.

PS: Before you make any drastic decisions, please do research, consult with an expert, and make a pros and cons list! Once you’ve done all of that if you’d like to transfer to Questrade, know that they do cover transfer fees in the form of a rebate (which was a massive bonus for me). If you use my link below, you’ll also receive $10,000 managed for free for a year when you open and contribute to a Questwealth Portfolios RRSP.

The most important consideration when it comes to your retirement fund is that it’s a reasonable cost and that the money you invest is properly taken care of. The worst feeling in the world is the fear of not knowing where your money is going, and that the person watching over said money isn’t doing their job for the right reasons.

Honestly, I’m just glad we all finally know what management fees are because it can be a lot of shock and a lot of “I’m paying what now?”

Today there are many ways to invest on a diversified basis beyond mutual funds – and there are much lower cost options – meaning you will keep more of your investment returns and could end up with 30% more money over the long term. See for yourself at questrade.com/calculator Do you need to invest more? No. You just need to do it smarter – with lower fee type products.

Don’t be afraid to do your research, confirm you have the lowest possible fees on your investments, and take advantage of the options available to you. Happy tax season, friend!

This post was sponsored by Questrade, but all personal thoughts and opinions throughout this blog post are my own. Please note that I am a Questrade affiliate.

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.