Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

Putting goals to paper is a powerful tool that has a significant impact on your ability to achieve them

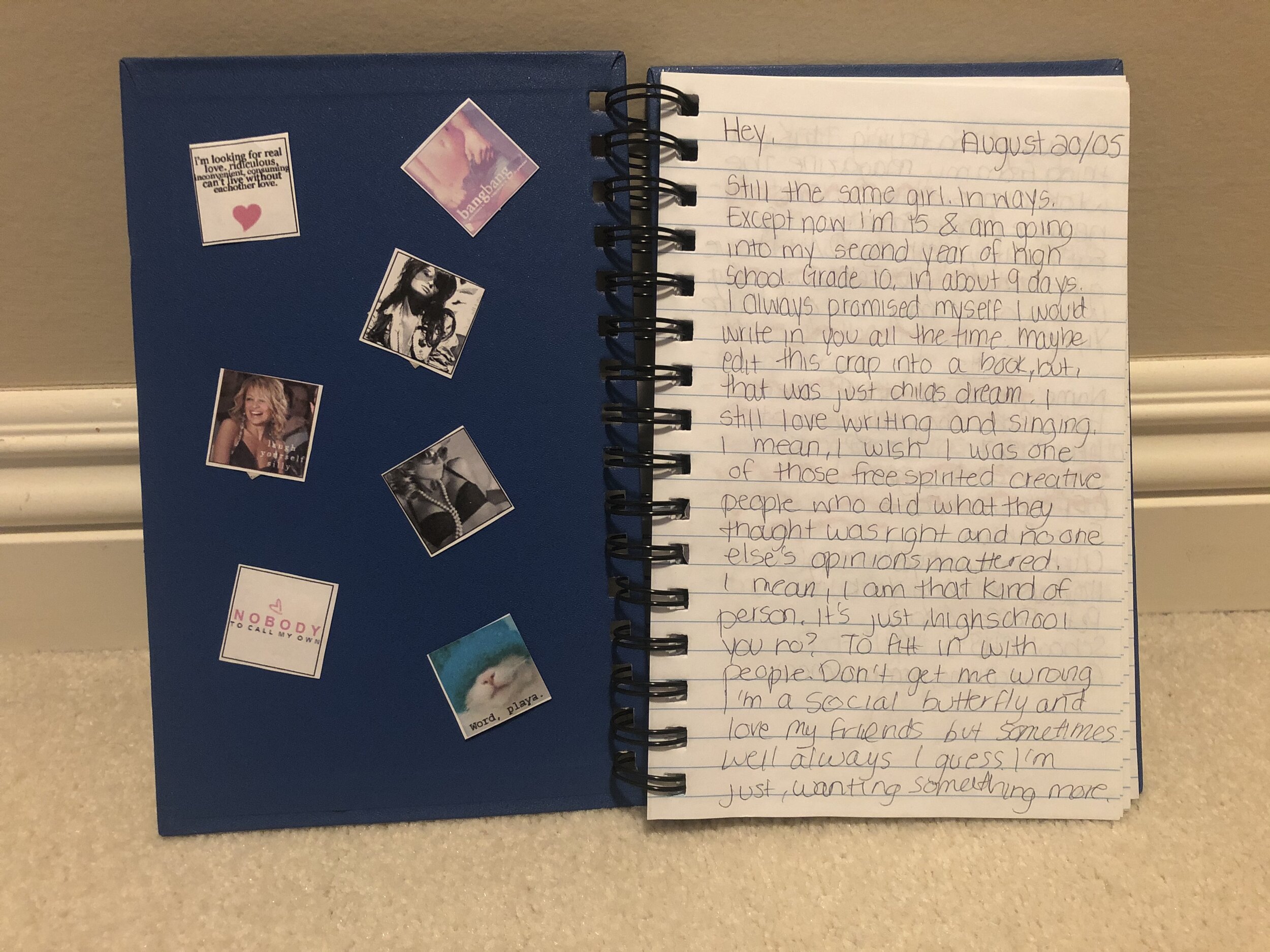

Ever since middle school, I’ve kept a journal. It used to be a dramatic look into my day to day life, lists of my favourite activities, my current crushes and the bottom to top rankings for my friends (I was 12). Please see one of these very important entries below:

When you think about a journal, you probably imagine your old “Dear Diary” moment, too. But, that’s not the only way or the only reason to keep a journal. About three years ago after looking for ways to control my negative thoughts, I bought a blank notebook so that I could practice daily gratitude. Each day I would write three things that I was grateful for. Ultimately, it helped me clear my head, reflect on the important things and provide perspective into the life I want to live and the person I want to be.

Writing is important – even if you don’t think you’re good at it. Reflection is something that we all need to do if we want to be successful in our financial life. At least, it is for me, and I want to share why.

Number 1: Goal Setting

Putting goals to paper is a powerful tool that has a significant impact on your ability to achieve them. Through journaling, you can also add specifics like timelines, checkpoints, and individual bullets/mini-goals – all of which will help contribute towards you reaching your future goals.

Last year, I spent most of my summer inside (because who needs sunshine) writing and putting together The 100 Day Financial Goal Journal: Build a Plan for Your Financial Future. In the journal, I put my personal practices for how I like to set goals, and how to go from managing your money because you have to, to managing your money with intention and understanding. We’re now less than one month away from launch day, and I’m so excited for you to be able to practice journaling in a way that makes sense for your financial life.

Number 2: Memories

This is a great place to store fond memories and keepsakes. No one is saying that you have to turn full-on scrapbooker in order to store your favourite moments, but maybe that’s something you’d enjoy. For me, photos and videos have always been such an important part of my day to day life. I want to remember how I was feeling in the moment and feel a visual connection. What pictures and videos lack, written memories and journal entries can fulfill. When I journal about my vacations, I remember the feelings I felt as I experienced something for the first time and the mood that I was in. Photos only show the memory, but they don’t always tell the complete story.

In the sense of money, my journal provides memories that are both good and bad. From the times I made a poor financial decision to the times I achieved a milestone I’d been working towards for months or years at a time – you need to remember them all equally.

Number 3: Personal Growth

A realistic habit would be writing down three positive things that happen to you throughout a day or week. Recording these highlights (or lowlights) makes reflection that much easier when you can look back to find out what is booting or leeching your energy day to day, month to month and so on.

Recently, my husband and I completed the YearCompass by the suggestion of a friend. If this were your typical New Year’s resolution, I may not be able to tell you what my goals are off the top of my head, but writing it down makes it real. Tracking your positive growth helps to avoid the negative self-talk we can often put on ourselves for not achieving something we set out to do.

Number 4: Improving My Memory

The digital world is exploding and it’s unrealistic for people to expect you to remember everything thrown at you each day. It is normal to feel like a super-evolved goldfish. Hey, the average animal memory span is 27 seconds so maybe we aren’t doing so bad? But in all seriousness, it’s scientifically proven that keeping a journal and regularly expressing your thoughts on paper can increase working memory capacity.

Sometimes, when you’re mind feels like it’s in a cloud and you are going through the motions after a draining week, you forget what you planned to accomplish that day or weekend. If you take a few minutes in the morning or at night, you’re giving yourself a fighting chance to remember what your intentions were for the day financially or otherwise.

Number 5: A Journal Is a Safe Space

When it comes to money, we all feel a lot of different emotions about our personal situations. If you feel shame, worry, or doubt, your journal is a safe place where you can own your feelings and your decisions. No one can tell you how you get to feel or why you should do certain things with your money.

If you need to track personal numbers and don’t feel comfortable doing so online or on an app, a journal is a perfect compromise. Budgeting apps don’t fit in my life. Instead, I write down my monthly expenses by hand at the end and start of each month, and give myself time and space to reflect on those purchases and bills.

Number 6: Accountability

The last and most important piece of the financial-journalling puzzle is how to hold yourself accountable. Money is an easy thing to talk circles around. Excuses come by the handful and when it’s just you and your credit card making the rounds, no one else can talk you out of a bad financial decision but yourself.

Journaling and accountability go hand in hand. The second you make a commitment and put pen to paper, there is no going back. You will see those written goals every single time you do your daily and weekly check-ins, and you won’t be able to stop yourself from feeling the desire to accomplish them.

If you’ve never journaled yourself, and aren’t sure if it’s for you, my only suggestion is to try it.

If you have a desire to be financially successful or accomplish a small financial goal in a short period of time, maybe you can even pick up my journal from your local bookstore, and start to write in small but impactful ways every single day.

You can be in control of your money. You just have to find what works for you.

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.