Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

It can be difficult to prepare for the unexpected

Owning a home is a significant responsibility. Not only do you have to maintain good financial standing and pay all of your monthly bills, but you also have to take care of your six-figure asset by continually fixing and working on the property. After all, it’s not going to increase in value if it’s not maintained over the years. But, one significant way to protect your home (and financial life) is by having a solid household emergency kit and plan.

You probably remember putting together a fire escape plan in middle school and your teacher asking whether your family had anything in place if this emergency would happen. We did not, but I found it very calming to know that if anything happened at our home, I’d have a piece of paper reminding me of everything I should do at that moment.

Being overprepared is something I’ve always been good at. So, as soon as I became a homeowner, it only made sense to continue down the path I knew very well.

The first thing we did before we closed on our home was making sure we had a full household emergency fund. It was (and should be to you, too) very important to us that we never felt house poor and that we would be able to afford any unexpected expenses that came our way.

Once we moved in, the next logical step was to build an emergency kit that could protect us from every emergency. I, like many people, put this off for a few months. Until 2020 hit (like a bag of bricks), and the paranoia became something of a reality.

What is in my household emergency kit?

Everyone (renters included) should have an emergency kit or grab bag that they can quickly access if they need to quickly evacuate their home. Depending on your personal needs, the emergency kit may have different medicines or toiletries. But, each emergency kit should, at minimum, include:

-

A first-aid kit

-

Your household emergency plan

-

A flashlight or matches and a candle

-

Water for each family member (typically that can last you up to 72-hours)

-

A small amount of cash

-

A blanket

-

Small tools

-

Spare clothing

-

Non-perishable food items

-

Personal protective equipment (masks, gloves, eye protection, etc.)

After doing a lot of research and spending a lot of time diving into every potential emergency disaster that we could face (including a couple of fun ones, like a zombie apocalypse) – I learned what we might need in an emergency kit. Our kit includes everything from the essentials list, plus a few additional personal items.

What other items do we have in our home to protect us from emergencies?

Aside from a backpack that we keep near the front door in our home, we also purchased a few other must-have items to protect ourselves from unexpected disasters. Although you may need to leave in a hurry, some household emergencies might need some additional attention or that may provide additional evacuation time, such as a flood.

As household fires are the most common disaster homeowners face, we bought essential items: a fire extinguisher, fire ladder, and fire blanket. We also wanted to keep all of our special documents safe, such as our estate plans and property information, so we chose to purchase a fire-safe lock box to store in a secure location.

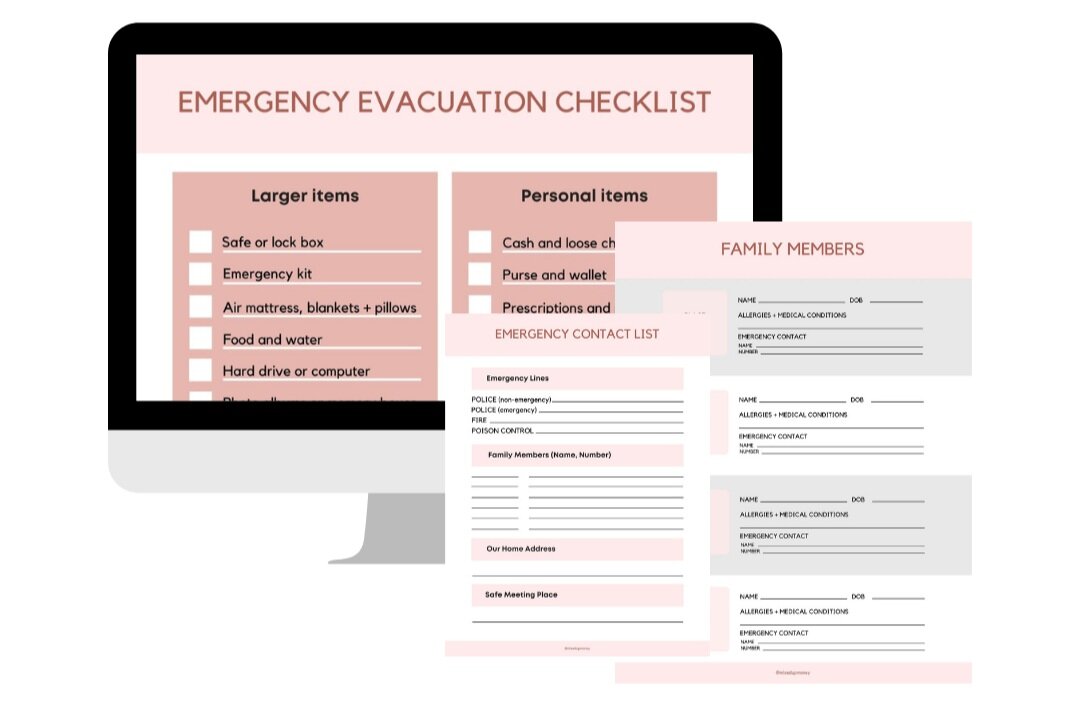

It can be challenging to keep the items you might need in case of evacuation on hand at all times. Instead, we have a laminated checklist that we store in our front closet that is easy enough to run through anytime this situation occurs. This checklist exists because anytime we are under stress, it is only human to panic and forget everything you may need to do in an emergency.

We want to encourage others to keep the same list as us on hand in their homes so that no one ever feels unprepared during a crisis. You can download our emergency preparedness guide for free.

Ultimately, every family is different and lives in another city, impacting what you feel you need in your home and what types of emergencies could affect your livelihood or home.

What kind of emergencies should you prepare for as a homeowner?

Emergencies can come in many forms. From financial troubles to natural disasters, you should always have a plan in place to protect yourself and your family.

For Canadians, the most common natural emergencies are as follows:

-

Household or forest fire

-

Flooding

-

Earthquakes

-

Extreme cold temperatures and snowstorms

-

Tornados

-

Earthquakes

-

Landslides

To confirm which natural disaster you’ll likely experience depending on where you live, you can check Public Safety Canada.

As far as household-specific emergencies, these are the most common:

-

Cooking related fires

-

Heating equipment fires

-

Electrical appliances setting on fire

-

Smoking or lighting candles in the home

The Canadian Red Cross has a great infographic to protect you and your family from these disasters and provides you with the best steps to take during these situations.

What can you do to protect yourself aside from having an emergency kit?

Now that you have all of the information you need to build an emergency kit for your family, the next natural step is to ensure you’re covered for all of these emergencies through home insurance. The first thing you may learn is that not every potential crisis is covered. Although most insurance will cover water damage at a minimum, from, say, a burst pipe, they may not be able to cover the damage caused to your home from a major flood.

If you do not yet have home insurance, do your due diligence to research and ask your insurance broker what they do in the case of a house fire, flood, or natural disaster. If you already have insurance, make sure you follow up to confirm you have enough coverage during any renewal period.

Emergencies might feel difficult to prepare for, considering you cannot predict the unexpected. But, that doesn’t mean you shouldn’t take the potential of one impacting you and your home seriously. Preparing by having the right precautionary plan and tools and the right insurance coverage is just as crucial as preparing financially. Both situations will impact your money in the end.

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.