Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

It was just what we imagined. Only better.

Planning a wedding on a budget might not scream a ‘dream event,’ but for me, finding a way to start life married to my partner meant keeping costs as manageable as possible while still enjoying our big day.

It should now be apparent that I am married, and therefore, officially off the market. Sorry to disappoint you all, but this year marks our fifth wedding anniversary, and things are still looking pretty good.

In 2016, my husband and I paid for our entire wedding by saving heavily over six months and by slowly paying off more oversized items as we inched closer and closer towards our wedding date.

Holding zero debt after the one life event that most couples struggle with was extremely important to us. We wanted to enter our marriage with a clean slate and clear VISA.

Before I go any further, I’m sure most people reading a personal finance blog may expect a modest and below-average budget. And, while it’s true that we are definitely below the average $40,000 wedding. It doesn’t mean we could spend just $5,000 and still have all that we wanted.

Both of us wanted to be able to spend a weekend away with our closest friends and family while allowing them to spend a minimal amount of money. As most of our best friends at the time were still in post-secondary or just graduated, we found it unfair to ask them to shell out for a destination wedding or a $500/night hotel room.

Where did we get married?

We chose to get married in Canmore, Alberta. Canmore is a beautiful town with mountain scenery – but it can also come with a hefty price tag during the summer months). However, we were smart-ish. The two of us chose this beautiful bed & breakfast to host our wedding weekend. We could rent out the entire facility from Thursday to Sunday and charge our guests whatever we felt was appropriate. Not only was breakfast a built-in part of the cost, but there were also more than enough rooms to sleep all 36 of our guests comfortably.

We asked our guests to pay $200 per person for their room, food, and alcohol for the entire weekend.

What was our wedding schedule?

Our weekend began on Thursday night, with a movie night for the wedding party and immediate family. On Friday, we had a small ceremony with only our wedding party and immediate family, and that evening, our remaining guests arrived for dinner and intimate reception.

To celebrate being a responsible and mature married couple, Saturday was a kickball game to determine which one of us would be the superior person in the relationship (I won) and an afternoon full of drinking games. Lastly, we enjoyed a Sunday morning goodbye brunch and thanked all of our friends and family for making our weekend as perfect as could be.

It was just what we imagined. Only better.

What made us even happier than all of the memories we shared during that special time was that we came in under budget.

*skies part, angels sing*.

Because, you know, we care about our finances.

What did we spend?

The first thing we did when we got engaged was sit down and put together our guest list. We wanted to see our starting point and make sure that we were on the same page.

The list quickly grew to over 100 people, and I started to feel overwhelmed. At that point, the thought of eloping was number one in my mind. Not only would it be cost-effective, but the fewer people staring at me as I walked down an aisle, the better.

My husband wasn’t exactly on board, so instead, we chose to do a very intimate wedding day that would cut down on the cost of the more typically expensive budget items, such as dinner and drinks.

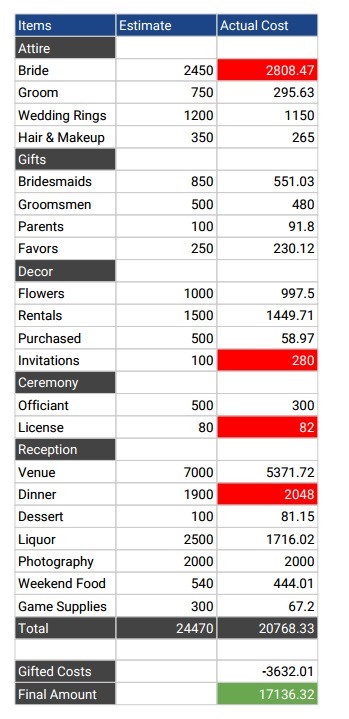

Our estimated budget came out to just over $20,000 – but in an ideal world, we wanted the total to be less. Before gifts from parents, our total cost of the big day was $20,768. After the gifted portion of our wedding, we spent $17,136.

Not only was our final wedding cost over $7,000 under our original estimation, but we also ended up breaking even after receiving wedding gifts. For us, it feels like we saved all of this money, took it out to admire our hard work, and then put it back in the account like nothing ever happened. Success!

What did our budget look like?

Now – for those who inspect my budget – perhaps currently judging, laughing, and choking at some of the numbers, I feel like this is my chance to defend or agree with all that you’re thinking.

How did we swing a smaller guest list?

The number one question we always get asked is how we managed to keep our guest list so small, and the final decisions we made to keep our list within reason were two-fold.

#1. We chose not to invite any extended family

While this wasn’t an easy decision, and most people don’t feel like they have this choice, we stood by the fact that this was our wedding, and fortunately, most of our family was understanding. It’s never easy to pick and choose family members, and because we felt it would be unfair to invite some and not others, it only made sense for us to keep it simple.

#2. All guests outside of immediate family needed to be mutual friends

This decision wasn’t easy. But, aside from our wedding party, which had five of our best friends on either side, any additional wedding guests we invited needed to be mutual friends. Not only did that make the day easier to celebrate because we knew everyone would get along, but it also narrowed down our list to get under 40 people.

We also told our best friends six months in advance that they would not have a plus one if they were not currently dating someone. I appreciate my friends for not thinking I’m a meany.

Although this doesn’t always work for everyone, I am the type of person that doesn’t ever expect an invitation to any event or wedding my friends and family host. Therefore, we hoped others would understand. Luckily, nearly everyone in our life did. And to this day, there are only two people we had at our wedding that we no longer speak to, so I’ll call that a win!

Let’s break down some of my expenses

#1. Attire

When it comes to a wedding dress, it’s not always easy to determine an appropriate budget. It’s true; I busted my budget on a wedding dress and jewelry that I’ll never wear again. At the time, my 18-year old self would have said, “don’t question it, girl, the photos say it all,” but my 26-year old self said, “you idiot.” Especially considering that at about 10:45 on my wedding night, I got way too low during Baby Got Back and busted the “back” wide open (#onlyme).

But, now, five years later, I’m still thrilled with each of my expenses, including the $2,000 piece of fabric that now sits in my closet untouched.

On the flip side, my partner killed his attire budget, got a suit on sale online, and did not need any alterations! Oh, to be a dude. As for the rest, I blame beauty magazines and Pinterest.

#2. Gifts

Gifts are an interesting wedding expense for many reasons. It’s difficult to determine how to appreciate guests that go out of their way to spend money on a day that is all about two people outside of themselves. We ask so much of our wedding guests, family members and wedding parties, so finding the right way to help them out is essential.

After a beautiful bachelorette weekend, a lovely and intimate bridal shower and many text message conversations about bridesmaid attire – to which they each purchased their chosen outfit, it was necessary to buy my girls a gift.

We decided to purchase pants and ties as a gift for the groomsmen so that they did not have to worry about finding clothing and asked that they bought a white button-up shirt if they didn’t have one on hand.

Lastly, we took our parents for a lovely champagne lunch as a gift, and our wedding favours were homemade tie-dye jerseys for the Saturday kickball event. Flashy, right?

#3. Decor

Thankfully, the bed and breakfast we got married in was beautiful enough without too many additional materials. Rentals included all of the table cloths, speakers, projector, chair covers, and beyond. Invitations were over budget because initially, I would make my own, cutting down the design costs and printing, but my laziness won out, and we ordered through Minted.

As far as flowers, I’m not picky, so I believe my exact words to the florist were “whatever would look best and was within my budget.” Each of my bridesmaids received a flower crown and small bouquet. I got a lovely bouquet myself, and then for the rest of the reception, I ordered a bucket of flowers for $200.

#4. The rest

The venue was the cost of the bed & breakfast in its entirety. Yes, for the whole weekend. Yes, for the setup and takedown of each event. Luckily for us, we were the first wedding the bed and breakfast had hosted since purchasing the renovating the location, which meant that we were fortunate enough to score a fantastic deal.

We were over budget on dinner because we opted for a sit-down instead of a buffet, which was the better option in my opinion. Dessert was donuts from Modern Jelly, and my lovely professional pastry chef friend from Calgary made & gifted us an incredible crepe cake.

Liquor was another one that we lucked out on, as we have quite a few friends who were able to slide us a deal or two. Thanks to our network, 90% of our booze came in at cost or staff pricing, saving us heaps of money in the long run. Buying liquor for a weekend filled with 36 wine and beer lovers was extremely hard. But we had a lot leftover, which is better than turning up dry. Did I mention it was an open bar?

The “weekend food” included lunches, dinners, and late-night snacks for Thursday to Sunday, and the game supplies were merely a permit to use a local field for our kickball game.

*takes a deep breath*

Well, now that I’ve written the longest blog post of my life, and you’re like, “okay, Alyssa, we get it,” I’ll move on.

What did I learn from my wedding planning experience?

In the end, weddings are expensive no matter which way you spin them. If a vendor hears the word “married,” you can guarantee the price will increase by a good 30-40%.

So, I learned some important lessons about the process (good and bad)

-

Flexibility will save you money and lots of it

-

The smaller the wedding, the more you can do

-

Let yourself lose control — just this one time

-

Treat your wedding day like any other day to avoid stress and nerves

-

Apple Music, or in my case, a sibling with good taste, makes for a great DJ

-

Know what you want before you put down any deposits

-

People are more generous than you’ll ever understand

-

Don’t worry about inviting everyone you know

-

Your wedding dress doesn’t care how much you love to dance

-

Nothing matters but your genuine love for one another

People told me that the day goes by so fast you won’t even remember it, which is why I spent my time relaxing, never in a rush, and always breathing in the important moments. My day didn’t go by too fast. Instead, it was just right.

There are no right or wrong ways to celebrate your relationship – whether you get married with 200 guests around you or opt to hop over to the courthouse on a Wednesday afternoon. Either way, finding a way to make sense of the cents can make a somewhat stressful event a lot more enjoyable when you know you can actually afford to enjoy every minute.

Before you get married, you need to talk about money!

My course, ‘Oh F*ck, Are We Ready to Talk About Money,’ is perfect for couples to learn how to navigate a typically uncomfortable conversation. You and your partner have experienced enough uncomfortable firsts. So, let’s not put ourselves through that again with our money.

What does the ‘Oh F*ck, Are We Ready to Talk About Money’ course get you?

✔ 15 exercises to help you better understand each others’ financial situation

✔ A 24-page printable workbook to use as you go through the course

✔ 7 video lessons to guide you through the tougher conversations

✔ 3 goal-setting tactics to help you plan your financial future together

✔ Quiz to help you identify the best way to manage your money

✔ Excel spreadsheet to manage your monthly budget separately or together

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.