Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

Your risk tolerance is continually changing

Investing can be an intimidating task. For some, it may even feel like a gamble. Will this work out in my favour? Or, am I better off putting my money to safer use? In reality, this “gambling” reputation is far from the truth. When done right, long-term investing is a safe strategy and can be tailored to meet your unique needs, even if that’s a low-risk portfolio. Yes, low-risk portfolios exist, and you may be wanting in on them. The thing to understand with investing, however, is the risk-return relationship.

The general rule is that the higher the risk, the higher the return. This rule stands for any single investment; however, you can tilt the formula in your favour through something called diversification. Diversification is the process of holding investments of different asset classes, geographies, and industries. Diversification within a portfolio can decrease your risk while maintaining your potential returns and is the perfect example of the saying, “don’t put all of your eggs in one basket.”

Although you can reduce your risk, it can be challenging to grow your money without some level of risk. After all, investment values are always changing, and markets may go through periods of increased volatility – and 2020 is a perfect example of this. The key to managing this volatility and ensuring you’re not gambling the stock market is by measuring your risk tolerance.

What is risk tolerance?

Like any part of the economy, investments go through periods of volatility. Volatility is not necessarily bad, as it can also lead to years of high returns. Financial planning doesn’t seek to eliminate volatility. Instead, it aims to increase your exposure during periods where you can handle it and decrease exposure during periods where you can’t — the higher your risk tolerance, the higher your resiliency to changes in returns. Your risk tolerance is continually changing, and different aspects make it up. Those aspects include financial resilience, emotional resilience, and resiliency due to the time horizon.

When you have a high-risk tolerance, you want to invest in riskier investments such as stocks and exchange-traded funds (ETFs). These are meant to be your high-return years, and without that increased risk, you won’t have enough to withstand the periods where you need to pull-back and potentially earn less. When you have a low-risk tolerance, you want to invest in low-risk options such as bonds and money market funds.

Generally, your investments won’t transition entirely from one to the other, but each will change your hold ratios. This is called your asset mix, or the percentage of each asset class that you own. Generally, there are three asset classes: cash & cash equivalents, fixed income, and equities. Cash & cash equivalents are nearly risk-free investments, fixed income is generally low-risk investments, and equities are medium-to-high-risk investments. When you have a low-risk tolerance, your asset mix will hold a higher percentage in cash & fixed income, and when you have a high-risk tolerance, your asset mix will maintain a higher percentage of equities. To benefit from diversification, it’s a good idea to own different asset classes at all times, even if only 10-20%.

How do you determine your risk tolerance?

After learning what risk tolerance is, you may be wondering about the elements that make it up. How do someone’s unique financial situation, time horizon, and emotional tendencies come into play when choosing their investments? What factor is most important, and what happens when two elements have opposite conclusions?

#1. Your financial situation

Your financial situation is one of the most important things to consider when looking at risk tolerance. If you don’t have an emergency fund or have very little saved with inconsistent income streams, your risk tolerance will automatically be low. Investing in stocks, mutual funds, or ETFs is only beneficial when you can park your money without touching it. Using investments as a form of a checking account is NEVER a good idea.

#2. Your time horizon

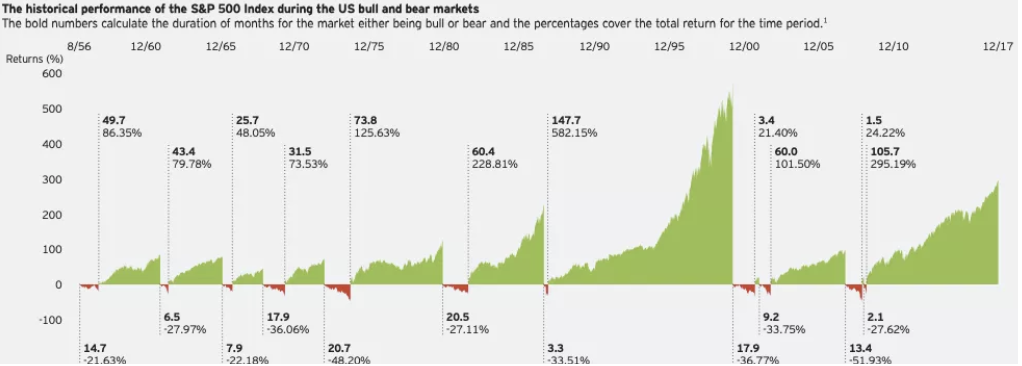

The second thing to consider is your time horizon. Time = resilience to volatility. One year of negative returns likely won’t matter by the time you need to cash your investments. Short-term, negative market volatility has always returned and provided more for investors in subsequent years, as you can see from the historical performance of the S&P 500.

The longest downward trending market was in the 1970s, and even then, the return for investors was -48.20%. The trend merely lasted less than two years (20.7 months to be exact). Although that may seem like a scary number if you compare that with the longest upward trending market between the 1980s and 2000, its duration was over twelve years and returned 582.15% for investors. All downward trending markets have eventually evened out. The key is having your money invested long enough to withstand them.

Those near retirement or those saving for an upcoming big purchase will often decrease their risk as they plan on using their money within a shorter period. When looking at both components and their collective impact, in my opinion, very few situations deviate from this general formula. A good financial situation + long time horizon = high risk tolerance.

#3. Your emotional tolerance

Emotions can play a huge role in investing, whether you realize it or not. It’s important to understand that changing your risk tolerance due to positive or negative emotions often happens, but it won’t benefit your portfolio.

You may not know, but the emotional side of investing is a well-researched topic of psychology. It’s known as behavioural finance and looks at why individuals make the investment decisions they do, even if they may be seen as irrational. It analyzes how outside influences such as past experiences, gender, religion, socio-economic class, or education can change decision making.

For example, men tend to be overconfident in their investing abilities *gasp*. A study by Money Crashers found that men tend to believe they can outperform the market and are less likely to seek investment advice and trade more. This overconfidence and resulting strategy caused men to underperform women by 0.4% annually, who were more likely to seek professional advice and hold their investments longer.

That’s right, ladies, our natural tendencies to overthink and make calculated decisions actually pays off. However, our worrywart tendencies tend to hinder that calculated decision-making, leading to overly conservative investments. Without bearing that additional risk when we can handle it, we will have a more challenging time growing our money enough to meet our financial goals.

Understanding these behavioural tendencies is essential in figuring out if they hold true in our financial lives. The more you know about them, the more you can analyze whether you’re taking the best course of financial action or potentially taking the one that plays into these irrational behaviours. Just remember that when looking at risk tolerance, your financial situation and time horizon are the main components, and you should try not to be steered in either direction by other influences potentially at play.

There are so many other common biases within behavioural finance, but some popular ones to look out for are the self-serving bias, herd mentality, and loss aversion. When related to finance, self-serving bias believes that all positive movements in a portfolio are due to skill, and all negative activities are due to bad luck. This could lead to repeated mistakes, a willingness to take on too much risk, and an inability to listen to financial advice.

Herd mentality tends to follow what other people are saying or doing to a damaging extent – whether through friends, family, or the news. Herd mentality is worse when you have limited information on a subject. For example, if you don’t know much about investing, but Uncle Tony is going on about how outstanding Apple stock is, and everyone at the dinner table is nodding their heads, you may be more tempted to buy Apple stock yourself. Loss aversion is an investor’s tendency to avoid losses at all costs, even if that means losing gains. Like I mentioned before, women are often victims of this, and it can be harmful to their long-term savings.

How to calculate your risk tolerance

You can calculate your risk tolerance through detailed answers to questions analyzing all three components that I mentioned. If you’re working with a financial advisor, risk tolerance is one of the first things discussed. If you’ve ever opened up an online brokerage account, likely you’ve had to answer similar questions.

Although I highly recommend speaking with a professional or doing extensive research before making any conclusions, there are many online risk profile questionnaires that you can fill out to get a sense of what to expect. Here’s a questionnaire for Canadians from Vanguard. You can mentally determine each question by analyzing your financial situation, time horizon, or emotional tolerance.

For example:

Q. My current or future income sources are stable or unstable? (Financial situation)

Q. I plan to begin withdrawing from my investments in how many years? (Time horizon)

Q. I would invest in a mutual fund based only on a brief conversation with a friend, coworker or relative? (Emotional tolerance, and more explicitly analyzing your herd mentality bias)

Investing is not gambling. With the uneasiness that’s currently taking place in the markets, maybe it can feel that way. Understanding your risk tolerance is an invaluable tool that can turn market volatility into opportunity. Sometimes it may seem like investing is a game of emotions, getting in one day when you’re feeling adventurous and getting out when your nerves are high. I hope that I was able to highlight how that shouldn’t be the case. Investing should be long-term, carefully analyzed, and sans emotions. Your risk tolerance is your guide, and you can tune out any outside noise with a good pair of headphones.

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.