Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

Are you ready to take on the financial obligation of being a homeowner?

In the news, you probably see headline after headline boasting about the insane real estate market that is hitting many major cities across Canada. From one home going for $250,000 over list price in Ottawa to another going for $700,000 over list price in Toronto — it might seem like a scary time to attempt to buy your first home.

Many Canadian homebuyers ask themselves when the best time to buy a home is over and over again. The problem with this question? It’s the wrong one. Trying to time the market, whether it’s the stock market or the real estate market, will never end well for investors.

For that reason, here are some excellent determinants of whether or not it’s a good time to buy a home, no matter where you live.

How to determine if it’s a good time to buy

When it comes to buying your first home, the best time to buy is once you can confidently say you are financially prepared. But, there are always other factors that may feed into your decision to purchase.

Consider the current real estate cycle

One thing about real estate is that although we cannot assume what’s to come or predict housing costs, historical data can tell the only story we need. Like the stock market, even the most experienced professionals do not know when it’s the best time to buy.

The only time anyone can know if it’s the best time to buy a home is when the prices start to rise again the following day. So, instead of gambling, the best thing to do is look at the historical real estate cycle.

According to the Canadian Real Estate Association (CREA) data, each year, home sales spike starting in April and continue to sell faster until the end of August. Most sales typically occur in May. Therefore, spring and summer could be a more competitive time to buy.

We can assume that over this period, you’d be buying in a seller’s market. A seller’s market means that it’s advantageous for sellers given the number of buyers versus the available inventory on the market. With fewer homes for sale, you can see many more bidding wars and homes selling over the list price.

The lowest month for sales is typically December, meaning it’s more of a buyer’s market. Fewer sales mean it is less competitive, and you may have a little bit more wiggle room to negotiate. This makes sense, given there aren’t many Canadian cities that would be a ton of fun to move in when it’s cold outside. Not to mention, it’s hard to view the landscape of a home while covered in snow.

Your financial situation is rock solid

Now that we can all agree, it’s impossible to predict the best time to buy. Instead, let’s remember that it’s essential to look at historical real estate data for a clearer picture. From there, the next deciding factor should always be your financial situation.

Before you buy, you’ll need to ensure a few financial tasks are taken care of, including:

-

Have a legitimate down payment (plus closing costs)

-

Save an emergency fund for any unexpected home expenses

-

Have a debt-to-income ratio of less than 36%

-

Have a solid credit score in the 600-700 range

-

Be able to provide all of these financial documents to your lenders

Although you don’t have to be perfect with your money to buy a home — and none of us are — it’s never a bad idea to be more prepared than the average homebuyer.

Here are three things we did with our finances before we bought our first home (that have all come in handy since the start of the pandemic):

-

Ran all of the numbers to ensure we could afford the mortgage and all housing expenses on one income in case of job loss or emergency

-

Saved an emergency fund that is specific to our needs as homeowners, and that would cover the cost of our most expensive appliance

-

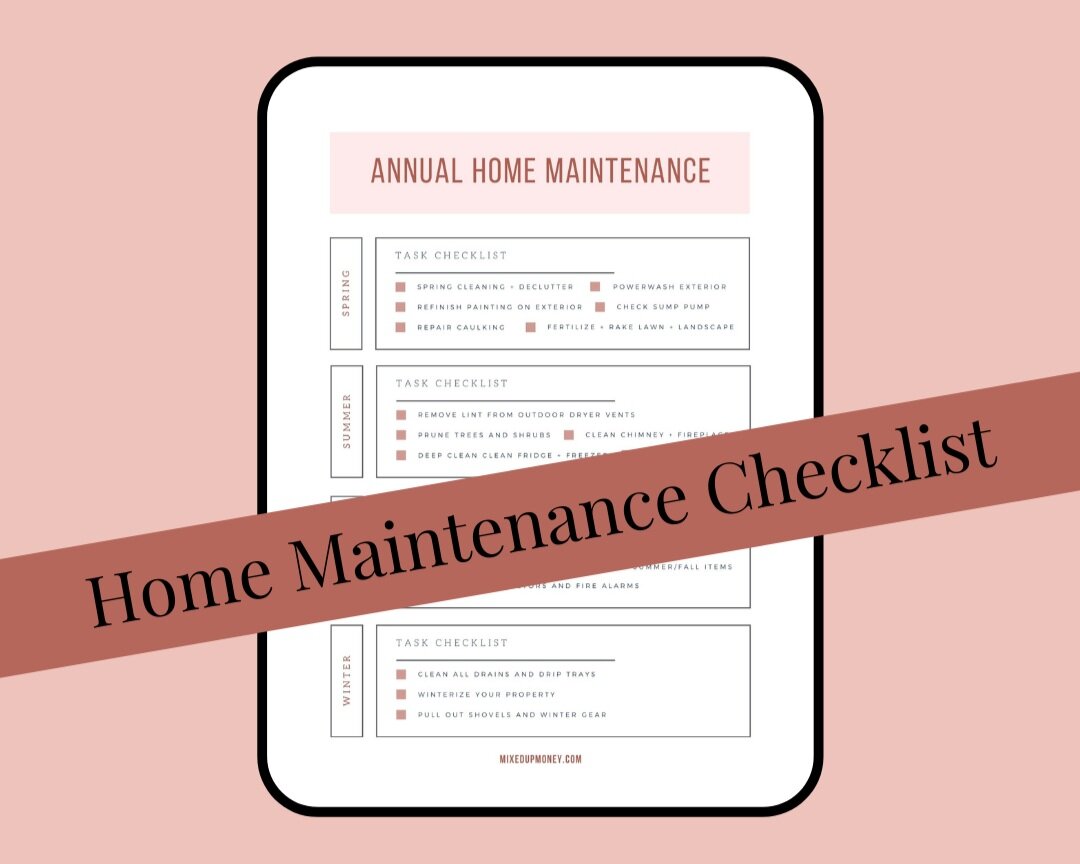

Made a printable checklist of all the home maintenance we should do each year and can check off as we go — because trust me, it’s a lot.

Factors to consider (but not be your driving force behind a decision to buy)

Aside from the cyclical side of real estate and your need to be in control of your finances, I’m sure you’re curious about some other common factors that people mention are leading their decision to buy.

Mortgage rates

A common theme during the pandemic has lead people to feel now is the best time to buy, given the Bank of Canada interest rates. Currently, the interest rate sits at 0.25%, and that is the lowest it can go.

As of now, the bank has confirmed they will hold still until at least 2023 when they predict the economy will be back at an inflation rate of 2% – or what they consider the comfort zone). In 2020, our inflation rate sat at 0.62%, with the previous low being 0.3% in 2009, one year after the 2008 recession.

Although low-interest rates are appealing, they also vastly affect the housing market. One thing to remember if you secure a low-interest rate is that your mortgage may not stay at that price forever. You need to be sure you can afford the same home price if, and when, interest rates jump up. Here’s an example of what a change in mortgage rate could cost you (taken from Financial Post and MoneyWise):

“The buyer of a typical $530,000 Canadian home who made a 10 percent down payment could have recently bagged a five-year fixed-rate mortgage at a low 1.39 percent. Amortized over 25 years, the loan would have cost the borrower $1,941 per month.

But today, that buyer might land a loan 15 basis points higher: 1.54 percent instead of 1.39 percent. The mortgage payment would be $1,975 — an increase of $34 a month, or $408 a year.”

Again, the bottom line is doing the math and making sure the numbers line up no matter what you decide to do.

Outside pressure

Typically, nothing is cut and dry when it comes to your financial life and your decisions because we are all in such unique positions. The one exception is when you are about to make a six-figure decision based on outside influence or pressure from friends and loved ones. This is never a good reason to purchase something.

Common reasons that I hear people wanting to buy homes include:

-

Feeling left behind

-

The fear of missing out (FOMO)

-

Wanting to get into the housing market before prices go even higher

Making things work or finding a way to scrape by when it comes to your financial future isn’t an excellent idea for a few reasons. For one, you could end up spending more money than you anticipate or put yourself in a difficult spot financially, forcing you to change any great habits you’ve built.

Renting is not a bad thing, and this is especially important to remember if you are constantly being told that it’s throwing money away. It’s a common misconception that buying a home is a good investment. But, you can learn more about why this may not be the case by reading When Should You Invest in Real Estate vs. The Stock Market?

Ultimately, the considerations that can lead us to decide whether now is the best time to buy a home should come from your financial situation rather than what the real estate news says. Paying attention to cycles and the market is essential. Still, so is looking at your lifestyle and confirming whether now makes sense to buy and take on the financial obligation of becoming a homeowner.

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.