Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

Unprecedented times, money is weird; just get by

If I had kept track of the number of times I’d written content this year that read something along the lines of ‘2020 was hard’ or ‘given the current circumstances due to COVID-19,’ it would be overwhelmingly A LOT. It’s not news to you that this year has been a complete whirlwind of many emotions. It’s frustrating to read or watch so many TV series and news reports that act as if we aren’t experiencing what’s happening first-hand ourselves.

In our household alone, we, fortunately, did not experience too significant of an impact. But, we still managed to overcome one furlough and one toddler who desperately misses social interaction. It was not how I envisioned my year to go. Things completely changed for me career-wise, and most of the plans I had for Mixed Up Money flipped in a few different directions. Regardless of these ups and downs, though, we are nearing the end of the weirdest year of our lives and moving forward into what I’m sure will be another odd year.

Because I felt an overwhelming amount of pressure to keep my mind occupied and my family in good standing both mentally and financially, we didn’t do nearly as much as we typically do with our money. Instead, our mindset fell more under a ‘the bills are paid, and the savings are saved, and everything else is moo’ moment.

Okay, okay, you get it. Unprecedented times, money is weird; just get by. Let’s look at the reality of 2020 based on my spending habits.

How much money did I spend, and what percentage of it went where?

Way back in 2017, I wrote an article exposing all of my spendings from 2016. Since then, I’ve avoided doing a full-year deep dive because I know that my lifestyle has inflated significantly.

To put things in perspective, in 2016, I spent $35,425. In 2020, I spent around $66,368. In just four years, my spending has gone up by 87% and if you’re wondering, yes, my head is spinning.

But, here is the thing. Four years ago, I was a renter and a newlywed. Today, I am a homeowner and a mom. Expenses tend to increase when you tack on a kid and a six-figure property to your budget.

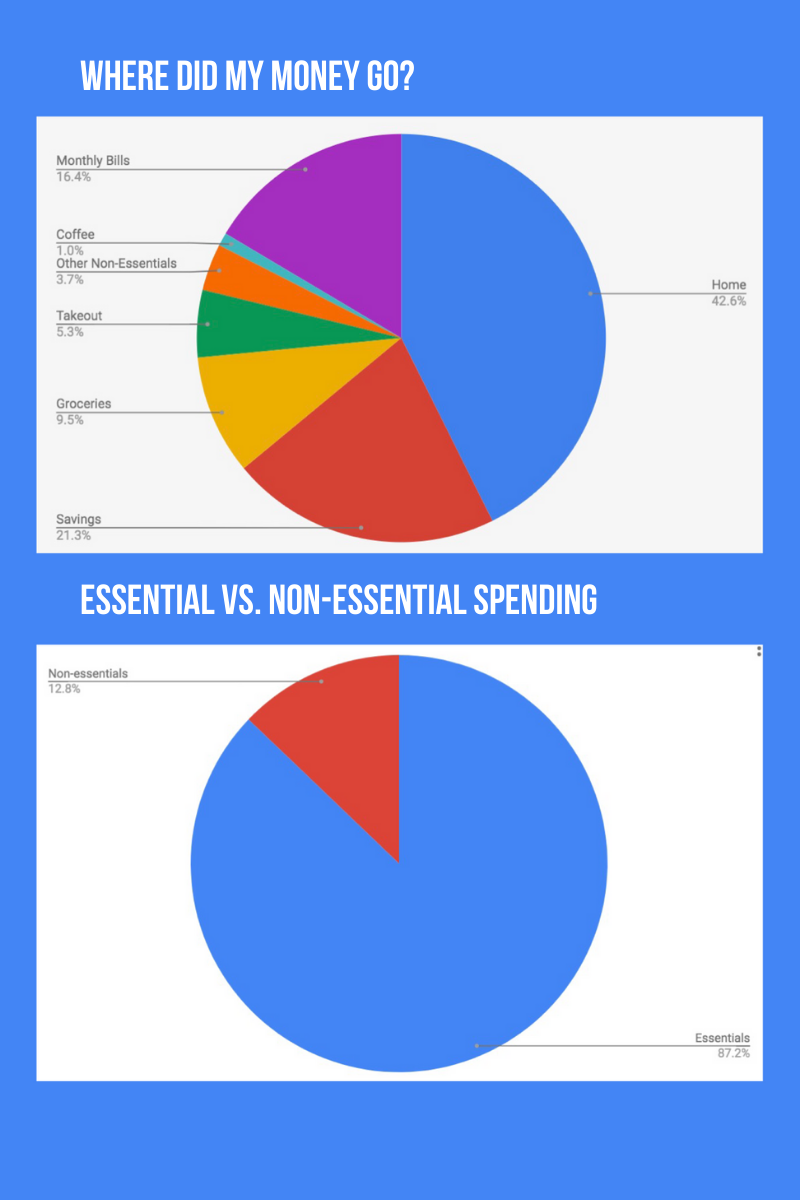

To put a percentage on my numbers, I chose to pull some exciting expenses while lumping together additional costs to keep the pie chart within reason. I tend to get carried away when I’m working with statistics, so bear with me.

-

Home includes my mortgage, property taxes, insurance, utilities, and repairs or updates

-

My savings includes short and long-term

-

Monthly bills include my subscription services, life insurance, phone and internet services, donations and my vehicle expenses

-

Other non-essentials (aside from my takeout and coffee habit) include clothing, beauty, recreation, home decor, and, to be honest, purchases to keep my two-year-old entertained throughout the pandemic

The only two categories that matter to me are whether I’m saving enough and whether my housing costs are reasonable.

Here is the breakdown:

Where did my money go in 2020?

The always-exciting question to ask ourselves is ‘where did all my money go?’ because it comes hand in hand with anxiety and adrenaline. If I spent nearly 80% of my annual income in 2020 – where did it go? And even more so, am I surprised or concerned with any of the numbers?

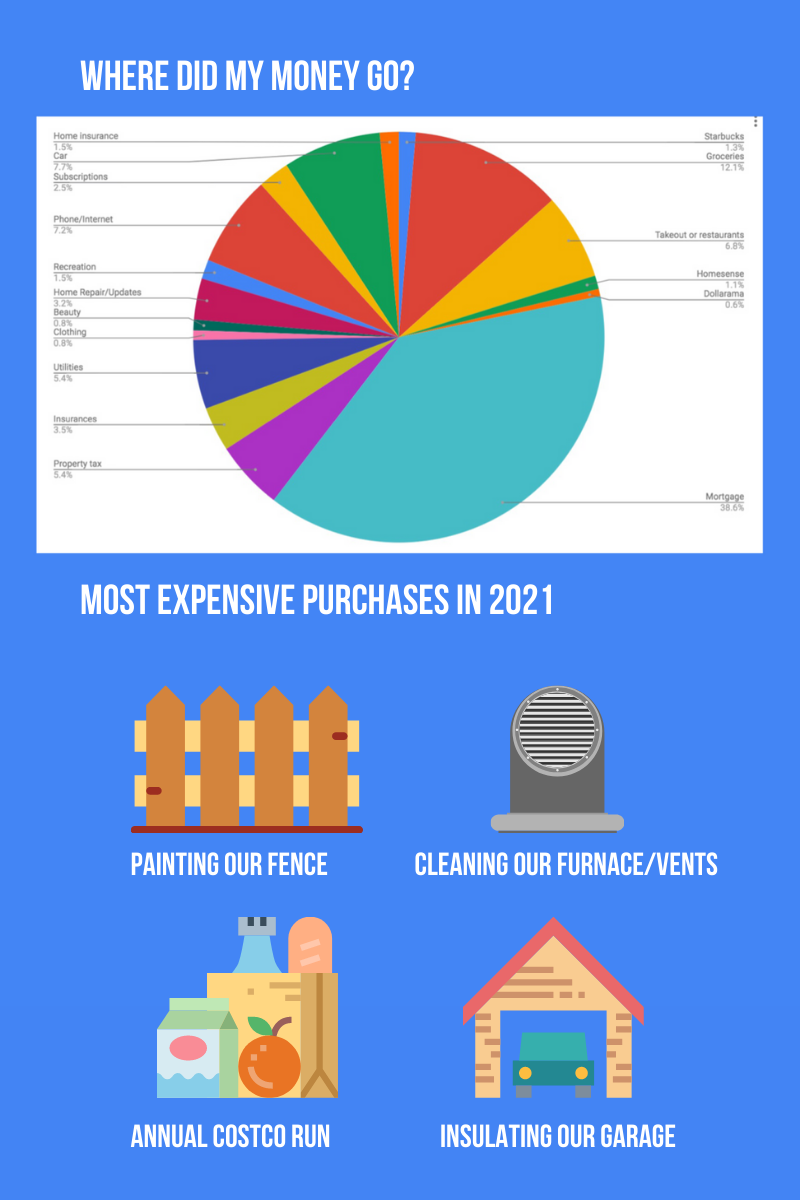

Let’s dive into some (not all) of my 2020 expenses.

#1. Starbucks coffee

People always ask me why I’m so obsessed with Starbucks and picking up a coffee. They always recommend I buy a nice coffee machine and make coffee and home and to that I say: I do! Even though I regularly go to Starbucks, I also have a Nespresso machine and a coffee machine at home that both get used quite frequently. I go to Starbucks of all places because, unfortunately, there are no local coffee shops near me, which I would much rather prefer.

In previous years to 2020, I could justify Starbucks because it was a nice change of pace and work environment for someone who works remotely. It got me out of the house and gave me social interaction. In 2020, I could find a million and one reasons to justify the purchase – and I did.

This year, I spent $875 at Starbucks.

In 2020, I apparently needed to have three to four Starbucks coffees every single week. I was beyond surprised, and honestly, for the first time, mad at myself. In what world did I need to be spending almost $75 a month or $20 a week on sugary (delicious) drinks? Oh right. It’s this world — the world of COVID-19.

#2. Takeout (plus three months of dining out)

As I was writing down every single expense in 2020 by hand, I got really tired of seeing Skip the Dishes pop up on my bank statements. I felt like I could hear DJ Khaled screaming ‘Another One’ over and over again in my ear. It was painful. Food was an exceptional expense for me in 2020. We found every excuse to justify ordering in. If my daughter wasn’t sleeping or we had a long day at work – takeout. Suppose we wanted to celebrate a new job or making it through another week – takeout. In June, my daughter had surgery done, and it wasn’t exactly a good time. So, we took advantage of meal delivery as often as we could.

This year, I spent $4500 on takeout.

I’ll be honest with you when I say that this expense shocked me the most. I couldn’t believe we spent $375 a month on food ABOVE and beyond our grocery expenses. After all, $375 in a month used to be our grocery budget, bringing me to my next cost.

#3. Groceries

When I finally tallied up the numbers of our grocery spending in 2020, I was wide-eyed and overwhelmed. I couldn’t understand how it was possible. In past years, I had raved about our $300 grocery budget, and the many unique tactics I use to save money were unbeatable. Unbeatable until a global pandemic, apparently. In 2020, we more than doubled our grocery spending.

This year, I spent $8,000 on groceries.

For a family of three in Canada, the average grocery spending is around $200/person each month. So, we’re nearly on target there. But it’s still very unlike us – until I did some thinking. At the start of the pandemic, my husband and I (like most people) were fearful of going to many places. Instead of going to our usual grocery store with better deals about 20 minutes away, we opted for the closest grocery store to our house that typically charges a bit more for the foods we buy. That change started to make a significant difference. Not only that, but we were now feeding a toddler instead of a baby – and our toddler happened to eat more produce than the two of us combined. It was a weird year, but I’m not anticipating this cost to decrease anytime soon, so it might be the right time to readjust our budget for the New Year.

#4. Dollarama

If you’re confused about how on earth Dollarama cracked my list of exciting purchases, you won’t be when you find out how much I managed to spend at a store where everything you buy is typically less than $5.

This year, I spent $380 at Dollarama.

Now you’re thinking, how often do you go to the dollar store, girl? It’s not that often. But when I do go, I go big. And why would that be? It’s because they have the best ‘in a pinch’ toys and activities for tired and stressed out moms who need to entertain their kids while also staying on budget. Usually, I would never go to the dollar store more than a couple of times throughout the year to pick up tissue paper and some birthday cards. But this year was different – a running theme throughout this post.

#5. Homesense

Although Homesense was only open for half the year in 2020, I still managed to go whenever I had some alone time to myself or wanted to make another update to our home. It’s one of my favourite places to shop because the prices are reasonable and the products are v cute. So, given that I wasn’t going anywhere other than the Homesense 15 minutes from my house, I figured it was worth the multiple trips.

This year, I spent $560 at Homesense.

Most of the purchases I made at Homesense this year were on gifts or to prepare for the holiday seasons with new and fun decorations. As soon as Christmas products started to hit the shelves, I was on board and in line.

Although this year was challenging in many ways, and we spent a lot more money than we have in previous years, we still manage to live below our means and save what we can for retirement. If I’m able to stay out of consumer debt and consistently pay my bills without worry, there isn’t much more to worry about unless I want to do more investing – which is always on the back of my mind.

Ultimately, spending money is always going to be there. So, taking the time to educate yourself on where that money is going and how you want to challenge those habits is more important than anything else.

Thanks for continuing to read my blog and support me as a creator. In less than two weeks, I’ll be on vacation for the remainder of the year, and I’d say now is the perfect time to end off an incredibly wild year. See you in 2021, pals!

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.