Mixed Up Money

START TRACKING YOUR SPEND

Get to know where you spend, how it makes you feel and what really matters when it comes to your money!

Grab your freebie!

Blog Categories

Let's stop pretending that being good at money means you need to be good at math. Instead, let's listen to our body and our mind.

Hi, I'm Alyssa Davies

no one person in a relationship is responsible for one area of livelihood

If you’re in a committed relationship, there is a high chance that one of you earns more income over the other. Statistically, if you are in a hetero-CIS relationship, the male is the one who makes the most money. Payscale did a study and found that as of 2020, women earn only $0.81 for every dollar a man makes.

This statistic, of course, doesn’t specify the differences for women of colour. But the Institute for Women’s Policy Research (IWPR) found that if the gender wage gap doesn’t change and continues to move at its current pace, it will be 40 years until white women earn equal to their male counterparts. For Black women, it’s 111 years, and for Latinx women, equal pay is 205 years away.

It’s essential we also note that sexual orientation wage gaps also exist – although some data shows that gay men and lesbians outearn their straight counterparts. Ultimately, each of these numbers proves how blatantly obvious discrepancies in relationships can be.

So, what is a breadwinner?

The term we historically used to describe the higher earner in a relationship or the sole-income provider is a breadwinner. Because the breadwinner contributes most of the household income, people see them as the primary financial support for the family’s livelihood. It, of course, makes sense.

If you bring home the money to cover household expenses, you are likely to pay for the bread. Most often, we use this term in single-income households. But in dual-income homes, this term would mean that the breadwinner has a more stable income, whereas the other earner would be able to afford to leave the workforce because their position is less critical.

You see, this is where things get a little bit ambiguous for me.

In a 2019 Institute for Family Studies (ISF), 25% of women are the primary breadwinner. For Black women, 35% outearn their husbands. Of course, the number dips by about 3% if there are children in the house because women typically take parental leave and lose income and earning potential long-term.

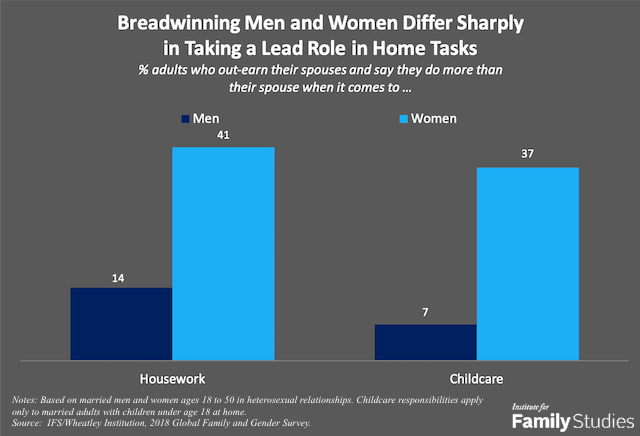

For women who are the breadwinner in their household, childcare and household chore responsibilities are much higher than men, even with the increased stress of providing financial support to their family.

The shocking part is that even though women are doing well with their careers and outearning their partner to provide stability for their families, they are 55% less likely to be happy than women who are not the breadwinner. Why? According to Pew Research, an equal share of chores around the house means more to a partner than income.

So, why is calling someone a breadwinner problematic?

Although the term breadwinner doesn’t seem to have a negative connotation, it can be frustrating that by earning the higher or sole income in your household, you are automatically in control of the decisions made. It’s also an assumption that you are not responsible for contributing to the relationship in other areas of your life because you earn more.

You see, having a significant other can be highly beneficial for your financial situation. After all, it’s relatively straightforward that having dual-incomes means that you earn more money. The caveat being that the only way a partnership can stay successful financially is if you consider one another as equals.

To achieve financial equity in a relationship, you can not use money as a weapon. One person does not control your needs and wants. Instead, you work together to share the burden of choosing what you spend — regardless of the discrepancy in earnings.

The more traditional way we use money in households makes men feel as though they need to be the higher earner for their family, and if they don’t, they aren’t enough of a man. But, that same ISF study found that “life satisfaction does not differ significantly among married men, whether they are the primary breadwinner or not.”

How do you talk about money in a relationship?

My course, ‘Oh F*ck, Are We Ready to Talk About Money,’ is perfect for couples to learn how to navigate a typically uncomfortable conversation. You and your partner have experienced enough uncomfortable firsts. So, let’s not put ourselves through that again with our money.

What does the ‘Oh F*ck, Are We Ready to Talk About Money’ course get you?

✔ 15 exercises to help you better understand each others’ financial situation

✔ A 24-page printable workbook to use as you go through the course

✔ 7 video lessons to guide you through the tougher conversations

✔ 3 goal-setting tactics to help you plan your financial future together

✔ Quiz to help you identify the best way to manage your money

✔ Excel spreadsheet to manage your monthly budget separately or together

Money is not the only way you provide support to your family. It’s ONE of the ways you give support to your family. And although this isn’t always easy to understand, it’s time we learn.

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.