Mixed Up Money

I was leaving over $100k of earning potential on the table One of the best parts of personal finance is the available options to personalize your money management. Over the past five years, I’ve made many changes to my style of saving, budgeting, and spending habits, but today I want to share with you how […]

Insurance saves me over $30,000 every year Side hustles, gig work, and freelancing are all now commonly used terms created from the growing phenomenon that is Canada’s contract work economy. Gig work includes less formal and short-term work arrangements that finish upon the completion of a task. Uber drivers, Instacart shoppers, and Skip the Dishes […]

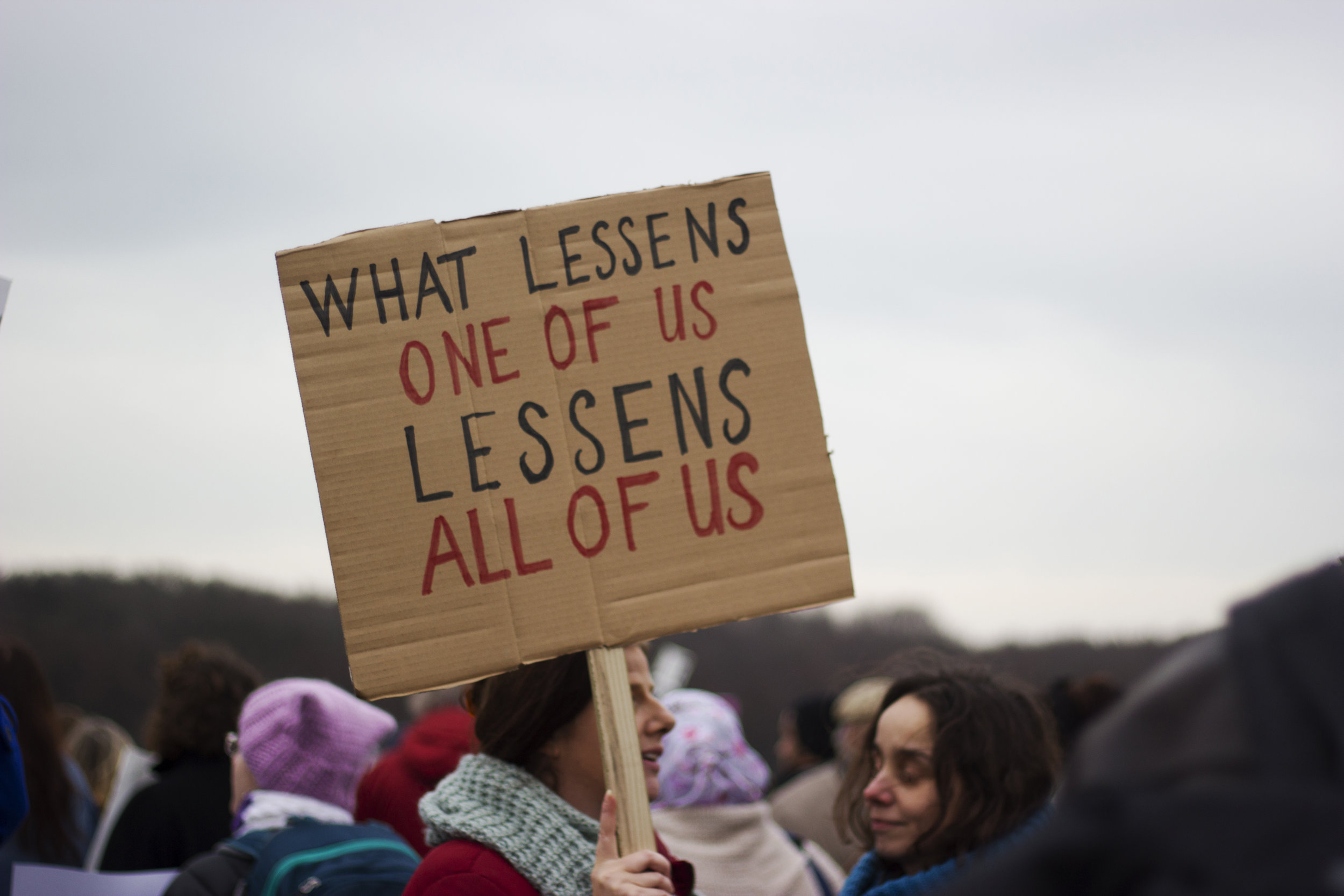

The ‘Pull Up for Change’ challenge is not something to be dismissed Since the tragic video of George Floyd’s murder was shared for millions on social media, a remarkable outpouring of support has been brought to a long-standing issue. Racism and police brutality against the black population is still prevalent, not only in America but […]

no one person in a relationship is responsible for one area of livelihood If you’re in a committed relationship, there is a high chance that one of you earns more income over the other. Statistically, if you are in a hetero-CIS relationship, the male is the one who makes the most money. Payscale did a […]

It’s crucial to analyze your spending every month COVID-19 has caused many changes in our day-to-day lives. Working from home, social distancing, and exclusively shopping online has not only changed the way we live but has drastically changed how we spend our money. Maybe you find yourself saving more than you ever have. Or, perhaps […]

Finally! It’s that time of year when we can spend the majority of our days outside and embrace the sunshine (without harming our precious skin — of course) and embrace our opportunity to grow new life. I’m talking about plants, obviously! As a new homeowner, I’ve looked forward to having my own garden and growing […]

Renters have increased power right now, and this could be an opportunity to capitalize on it I am a renter, and I have family members who are landlords. I have neighbours who have lost their jobs, and family members who haven’t been paid by their tenants in months. Both sides are facing challenges, and I […]

Without open dialogue, we are choosing to avoid a severe issue actively. This time last week, I was planning to write a blog post about my ‘affordable’ home garden. Today, it would be irresponsible to write about anything other than what we can do as white people to support Black Americans. I don’t have the […]

However much you choose to save for your child’s education is a personal choice The day your baby arrives in the world, the last thing on your mind is all of the underlying responsibilities that take place, aside from keeping them alive. I’ll never forget when the doctor came in just 24 hours after my daughter’s birth […]

She is the founder of the two-time award-winning Canadian Personal Finance Blog of the Year, Mixed Up Money which has over 100,000 followers across social media. Through her work, she has been featured in many notable publications, including The Globe and Mail, CNBC, CBC, and more. Her books, The 100 Day Financial Goal Journal and Financial First Aid are currently available for purchase.

Alyssa is a freelance writer and enjoys writing about personal finance, homeownership, and more. When she’s not writing, you can find her enjoying some downtime with her kids, playing soccer or daydreaming about home decor.

Alyssa Davies is a content manager for Zolo, Trauma of Money facilitator and a published author living in Calgary, Alberta.

I'm Alyssa! Welcome to my corner of the internet!

Meet Our Founder

This one's on me. Complimentary free stuff coming right up.

leaving so soon?

Oh no, you missed the live webinar! But, good news: Mixed Up Money is pleased to share a resource for anyone planning for a future child or family.

financially preparing for baby

Mixed Up Money is pleased to share a free resource for anyone looking to cut back on non-essential spending. My most-requested product is these monthly calendars to share on your Instagram story, use as a phone background, or print off to track your spending habits.